The yield curve is a graphical representation that shows the relationship between the interest rates (yields) of bonds with different maturities, typically for government bonds of the same credit quality. It plots bond yields on the vertical axis and maturities on the horizontal axis, helping investors understand how interest rates change over time.

Types of yield curves

There are several types of yield curves:

Normal yield curve

Slopes upward, indicating that longer-term bonds have higher yields than short-term bonds, this can reflect expectations of economic growth and higher inflation in the future.

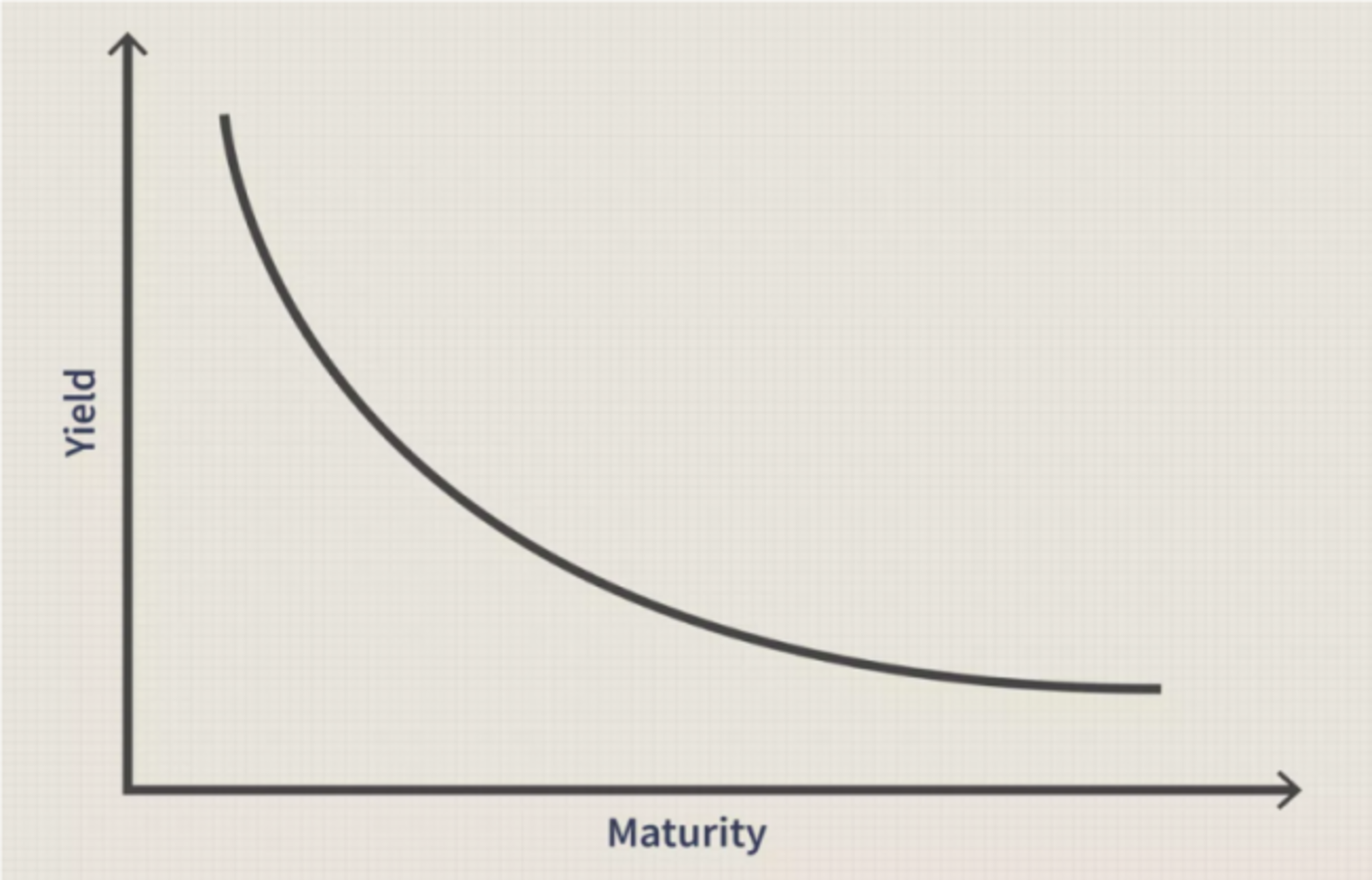

Inverted yield curve

Slopes downward, where short-term bonds have higher yields than long-term bonds, can be seen as a signal of an impending economic recession.

Flat yield curve

Indicates that short- and long-term yields are similar, suggesting uncertainty in the economic outlook.

The shape of the yield curve is influenced by factors like interest rate expectations, economic conditions, and central bank policies. It serves as a valuable tool for assessing economic conditions, guiding investment decisions, and shaping monetary policy.

Investors and policymakers monitor yield curve movements closely, as changes in its shape can signal shifts in economic growth, inflation, or risk sentiment, impacting both bond markets and broader financial markets.

Also read