Active Quant strategies offer diversified return profiles, enhancing alpha potential while managing risk and reducing reliance on single investment styles.

In increasingly unpredictable markets, investors who seek high alpha1 within a moderate risk budget can benefit from systematic investment approaches that keep emotions at bay. Enter Active Quant – a quant strategy that is highly effective at analyzing vast amounts of opportunities and exploiting market inefficiencies resulting from predictable patterns. Active Quant uses the breadth of any investment universe to its advantage in its aim of delivering consistent, index-beating returns.

1Alpha refers to the excess return of an investment relative to a benchmark index and is a measure of performance.

Evolving investment landscape, evolving technologies

In the decades when markets delivered reliably high returns, just being in the market did much of the heavy lifting for investors. But the tide may be turning. As the equity risk premium diminishes and market volatility rises, alpha – the return generated through skill and strategy – becomes increasingly important.

At the same time, rapid advances in technology and data have unlocked further opportunities for systematic investing. Quant solutions that adapt to the market and harness these advances can combine precision, cost-efficiency, and risk control with the potential for alpha.

Active Quant: finding alpha with confidence

Blending data-driven insights, risk control and quant expertise to pursue reliable returns.

Why Active Quant?

Building on the same powerful quant engine behind our other systematic strategies, Active Quant is designed to go further – adding a higher tracking error and an emphasis on alpha generation. It combines our proprietary stock selection model with both long-term signals like value and quality and dynamic ones like momentum, analyst revisions, and short-term reversal signals.

By diversifying across these multiple investment signals that have non-correlated return streams, Active Quant reduces reliance on single investment styles. It leverages technological advances in its aim to deliver systematic, stable outperformance across varying market conditions while managing risk, and can strengthen portfolios by complementing both passive and fundamental allocations.

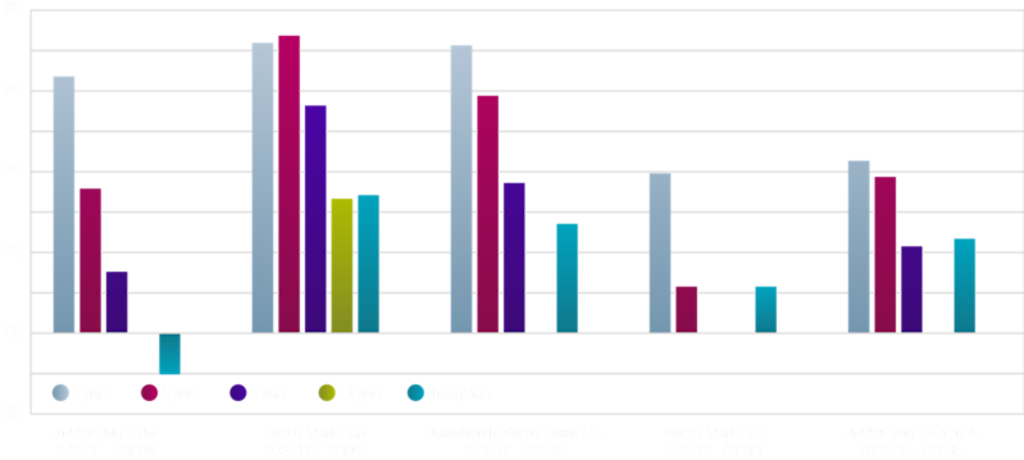

Figure 1 | Relative returns of Robeco Active Quant strategies

Past performance is no guarantee of future results. The value of your investments may fluctuate. Source: Robeco. Illustrative strategy. Figures are based on the live portfolios in the strategies in euros and gross of fees. Inception dates: Global Developed Active Equity strategy: May 2018. Active Quant Emerging Markets Equity strategy: March 2008. Emerging Markets Sustainable Active Equity strategy: February 2015. European Active Quant TE 2% Equity: July 2020. Chinese A-share Active Equity strategy: January 2018. Performance measured against MSCI World, MSCI EM, MSCI EM, MSCI Europe and MSCI China A International, respectively. The currency in which the past performance is displayed may differ from the currency of your country of residence. Due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. In reality, costs (such as management fees and other costs) are charged. These have a negative effect on the returns shown. Data as of December 2024.

Why Robeco?

With over 25 years of expertise, Robeco is a leader in quant investing. Backed by cutting-edge research, a robust infrastructure and advanced tools, our strategies combine innovation and rigor to deliver consistent results. Active Quant benefits from this deep experience, offering a reliable, systematic approach to alpha generation while maintaining strong risk management.

Sustainability

This strategy promotes, among other characteristics, environmental and/or social characteristics, which can include exclusionary screening, ESG integration, ESG risk monitoring and active ownership.

QI Emerging Markets 3D Active Equities I EUR

- performance ytd (31-1)

- 5.56%

- Performance 3y (31-1)

- 16.87%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No