Quant chart: Has goodwill accounting gone bad?

In 2000, in one of the largest acquisitions in history, Vodafone acquired Mannesmann for USD 202.8 billion, and recorded a goodwill of USD 129.2 billion.1In this month’s quant chart, we highlight recent developments around goodwill and potentially substantial impairments, arguing that investors should be more aware than ever of the risks of high goodwill numbers on balance sheets.

What is goodwill? In an acquisition or merger, companies record goodwill on their balance sheets when they pay a premium for an enterprise over its net asset value. Once the deal is completed, this premium is included in intangible assets on the balance sheet and reflects the value of a company’s brand, customer relationships, employee relations, and other factors that contribute to its earnings power beyond just physical assets.

The treatment of goodwill in accounting after an acquisition has undergone a significant shift over the last decades. Historically, companies were required to amortize goodwill periodically, reducing its value on the balance sheet over time regardless of the actual value derived from the acquisition.

Active Quant: finding alpha with confidence

Blending data-driven insights, risk control and quant expertise to pursue reliable returns.

Moving to impairment only

However, a notable change in accounting standards, initiated by the Financial Accounting Standards Board (FASB) in 2001 and followed by the International Accounting Standards Board (IASB) in 2004, has moved toward an impairment-only approach. This model mandates that goodwill is tested annually for impairment rather than being systematically amortized. Impairments occur when the carrying amount of goodwill exceeds its estimated fair value, indicating that the expected benefits of the acquisition have decreased.

While proponents argue that these reforms improved financial reporting because financial statements better reflect the true economic value of the acquired assets, opponents counter that the new standards have resulted in relatively inflated goodwill balances and untimely impairments.2

Moreover, critics point to the subjective nature of impairment tests and suggest that managers are presumably reluctant to impair goodwill, as any impairment is likely to be interpreted as an admission that they overpaid for the associated business acquisition.

What the data tells us

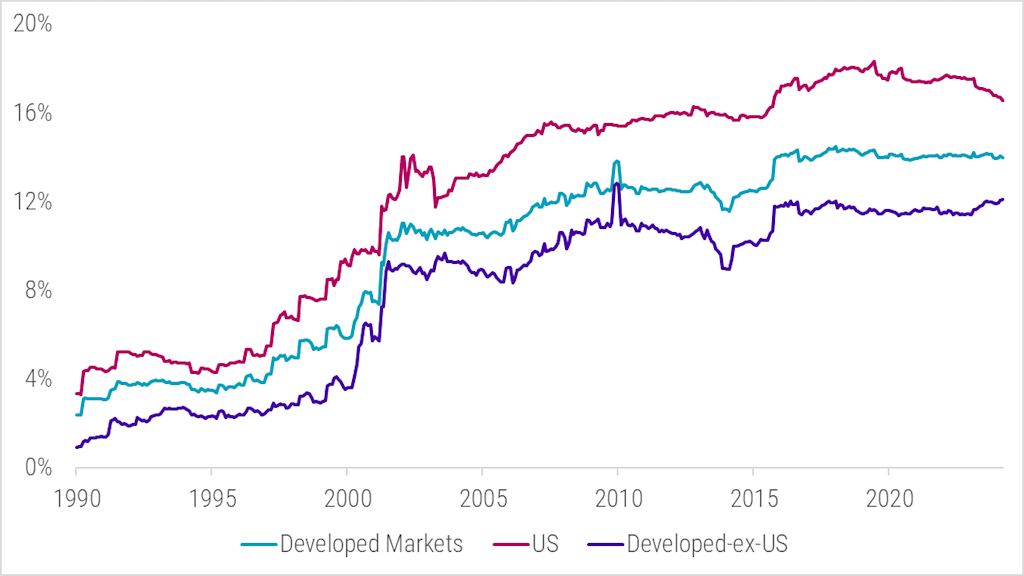

Figure 1 | Reported goodwill on balance sheet relative to total assets per region

Source: Robeco, Refinitiv. The figure shows aggregated reported goodwill relative to the aggregated total assets per region and over time. Both goodwill and total assets are winsorized at the 99% level to remove the effect of a few data errors. The investment universe consists of all non-financial constituents of the MSCI Developed Indices. Before 2001, we used the FTSE World Developed Index. The sample period is January 1990 to March 2024

But what does the data tell us about the development of goodwill over time? Figure 1 illustrates the aggregated reported goodwill on the balance sheet in relation to the aggregated total assets, focusing on developed markets and distinguishing between those outside the US and the US itself.

Before 2000, reported goodwill accounted for approximately 3% and 7% of total assets for developed markets outside the US and the US, respectively. However, following the accounting reforms in the early 2000s, these numbers quickly increased to about 11% and 15%. Looking under the hood of these aggregated numbers, we see that they aren’t driven by just a handful or a dozen stocks but a broader phenomenon. Sector-wise, the portion of goodwill is currently highest for information technology, health care, and consumer staples. However, we also see that the other sectors nowadays have higher levels than pre-2000.

While the increase in goodwill often reflects confidence in the value of acquired assets and anticipated synergies, it carries significant risks. Elevated goodwill figures may indicate over-optimism about acquisitions’ future profitability and integration success or a sign of earnings management. In periods of economic downturn or when acquisitions fail to meet expectations, significant impairments may occur, leading to substantial charges against earnings. For instance, Kraft Heinz wrote down the value of some of its best-known brands by more than USD 15 billion in 2019, resulting in a 28% decline in its stock.3

Similarly, shifts in leadership can prompt reevaluations of asset values, as seen when General Electric and British American Tobacco reported goodwill impairments of USD 23 billion in 2018 and USD 31.5 billion in 2023, respectively. 4,5

In general, we observe that the portfolio of goodwill on balance sheets has slightly come down in the US in the most recent years, a trend that might continue. In contrast, the goodwill portion on balance sheets of around 12% has remained relatively stable outside the US. However, the IASB published a proposal in March 2024, according to which companies would have to disclose more detailed information if acquisitions live up to their initial promise and in which segments the reported goodwill is reported.6 These proposals would help investors to evaluate the reported goodwill numbers better and might also lead to lower reported levels and higher goodwill impairments going forward.

In light of these recent developments and potentially substantial impairments, investors should be aware of the risks of high goodwill numbers on balance sheets. Understanding these risks is key to making informed investment decisions and navigating the potential financial instability they may introduce.

Footnotes

1 Institute for Mergers, Acquisitions and Alliances, February 2023, Goodwill in Mergers & Acquisitions.

2 Li, K., and Sloan, R., May 2017, Has goodwill accounting gone bad? Review of Accounting Studies, 22(2), 964–1003.

3 Giammona, C., February 2019, Kraft Heinz Plunges to Record Low on Writedown of Brands' Value, Bloomberg article.

4 Crooks, E., October 2018, GE’s $23bn writedown is a case of goodwill gone bad, Financial Times article.

5 Haigh, R., January 2024, Strategic Impairment at British American Tobacco, Brand Finance.

6IASB, March 2024, Business Combinations—Disclosures, Goodwill and Impairment, Proposed amendments to IFRS 3 and IAS 36.