Land of the rising yield

One of the world’s largest experiments in financial engineering may be about to come to an end, spelling a new era of higher yields in Japan.

Summary

- Japan may end yield curve control and negative interest rate policy

- Tipping point reached for Japanese government bond yields to rise

- We believe the move creates a ‘shorting’ opportunity on any asset price falls

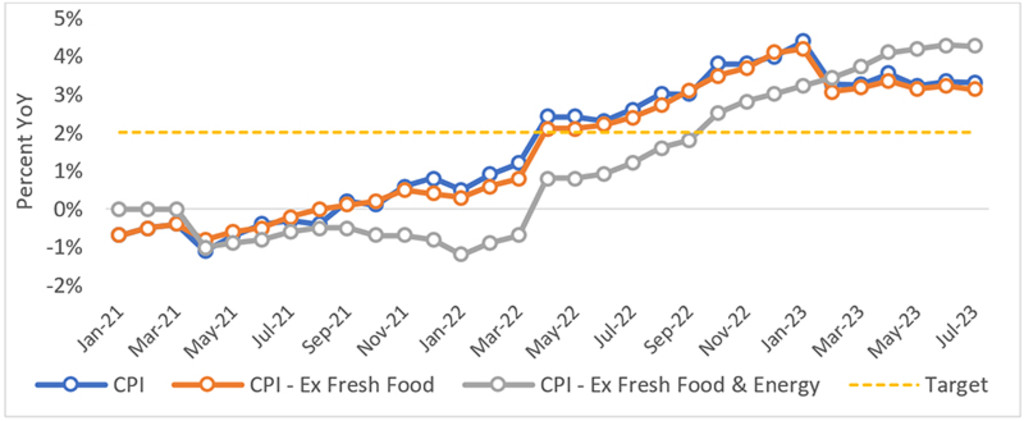

The country has battled with trying to achieve a 2% inflation rate for more than two decades, originally attempting to reach this level from below. While Japan has recently experienced higher inflation numbers, Japan’s central bank has not declared victory yet.

It’s been a long fight. To try to provoke inflation, a huge quantitative easing program was launched in 2001, followed by a globally unprecedented yield curve control (YCC) program in 2016 to artificially fix bond returns and stop the rise in the value of the yen, which was importing deflation. This was backed by a negative interest rate policy (NIRP) to encourage people to spend, and not save money at a loss.

Now, both the YCC and NIRP could be abandoned as Japan tries to bring inflation back to 2% and return to normal economics, says Mathieu van Roon, Portfolio Manager with Robeco Sustainable Multi Asset Solutions. That means Japanese government bond (JGBs) yields will finally start to rise, making the asset class less attractive to investors and creating an opportunity for ‘shorting’ this market.

“After several decades, we are finally at the tipping point for Japanese yields to move higher,” says Van Roon. “Ever since the Japanese economic bubble burst in the early 1990s, Japan has sought ways to exit deflation, but to no avail.”

“Recently, the sticky higher inflation rate, lower yen and higher level of economic growth have put pressure on the YCC and NIRP of the Bank of Japan. Does this mean the ‘death of the acronym’, or DOTA – as we refer to it tongue-in-cheek – for Japan?”

Japan’s inflation rates are above the 2% target. Source: Robeco, Bloomberg, Japanese Ministry of Internal Affairs and Communications (MIC), using data from 1 January 2021 to 31 July 2023.

Beginning of QE

Japan’s giant QE program began as a means of addressing a recession that started in 2001. In a QE program, the central bank electronically creates money and uses it to buy government bonds to increase financial liquidity and stimulate the economy.

“This failed to raise inflation and the sheer size of the program began to reach its limits after the central bank had bought nearly half of all of Japan’s outstanding government debt,” Van Roon says.

“To address this, YCC was introduced in January 2016, adding a yield target for short-term debt of -0.1% to fend off an unwelcome rise in the yen. Eight months later, a target of 0% for 10-year rates was added to pull up long-term yields.”

“Although YCC meant less debt needed to be bought by the BoJ – only at a level necessary to reach the target – it still meant that trading volumes dwindled, and yields became closely anchored to the target levels.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

From deflation to inflation

In a different era, in which global inflation was sparked by the Russian war in Ukraine and the resulting spike in food and energy prices, inflation is now well above target in Japan, at about 3.1% excluding food, and 4.3% excluding food and energy.

“One factor driving up inflation is the fact that Japan currently imports most of its food and energy from abroad,” Van Roon says. “The longer the YCC continues, the higher the probability of disorderly yen weakness, and thus further importing inflation from abroad.”

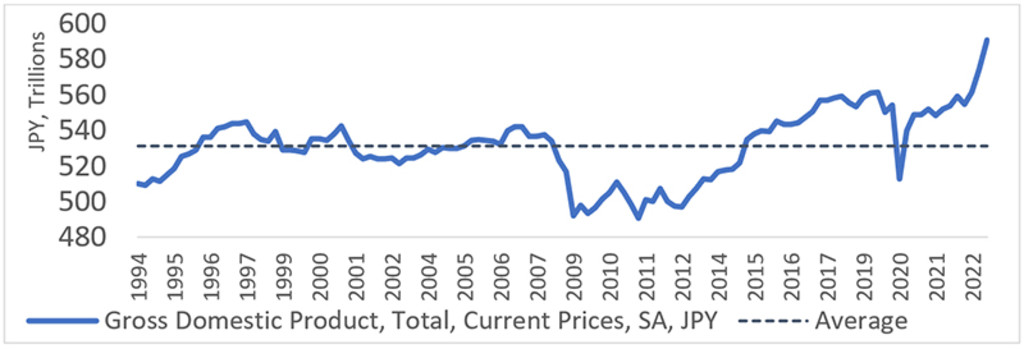

“The broad-based sticky inflation with the lower yen in combination with Japan’s increased economic growth, and potentially further wage increases means, that we expect the inflation rate to stay well above the 2% target.”

“That means that the BoJ’s policies are bearing fruit, allowing them to further tweak or even abandon the YCC altogether – followed by ending the NIRP – and putting upward pressure on the 10-year yield.”

Japan’s GDP has been rising. Source: Robeco, Bloomberg, Japanese Cabinet Office, using data from 1 January 1994 to 31 December 2022.

Shorting opportunity

As bond prices move inversely to yields, a rising yield means the value of the bond falls, making them less attractive to investors. But it does also provide opportunity potential to short the market – where an investor expects the asset value to fall and monetizes the price differential using derivatives.

“We believe the 10-year yield will grind higher over the coming months at a slow but steady pace until the YCC is adjusted or abandoned, after which the upward pressure is even bigger,” Van Roon says. “Attempting to capitalize on this means choosing an instrument that can bear the slow movement (no high running costs) and which provides a more asymmetric pay-off.”

“While the yen and equity markets will react strongly to any adjustments in YCC or NIRP, the risk profile is much more symmetrical. So, we believe shorting the 10-year government bond (or using bond futures) is the most efficient means of doing this at the current yield levels of close to 0.6%.”

“Given the effectively lower and upper bound (0.5%-1.0%) in the yield range, there is more upside than downside. Shorting does mean paying the yield pick-up and roll-down – and potentially paying financing costs if futures are used – but these are thanks to the YCC being relatively benign and thus allowing us to hold the position for longer.”