The decarbonization of property is accelerating

The property sector is crucial to efforts to decarbonize the global economy, but while progress is being made, the effort and achievement is uneven so far.

Summary

- The top 200 largest listed real estate companies decreased carbon emissions by 4.7% in 2021, but cross-sector variance is significant.

- Real estate companies improved carbon emissions disclosure and target setting in 2021, particularly with regards to scope 3 emissions.

- Future regulations are anticipated to focus not only on overall carbon emissions, but also energy intensity of individual assets.

Decarbonization in real estate is a race against time. Governments have set the path for reduced emissions, with the goal of transitioning to a low-carbon or even carbon-neutral future. The property sector plays a significant role in this decarbonization journey, as it accounts for approximately 40% of annual global greenhouse gas (GHG) emissions1. The sector is making big strides toward decarbonization, but are we close to where we need to be?

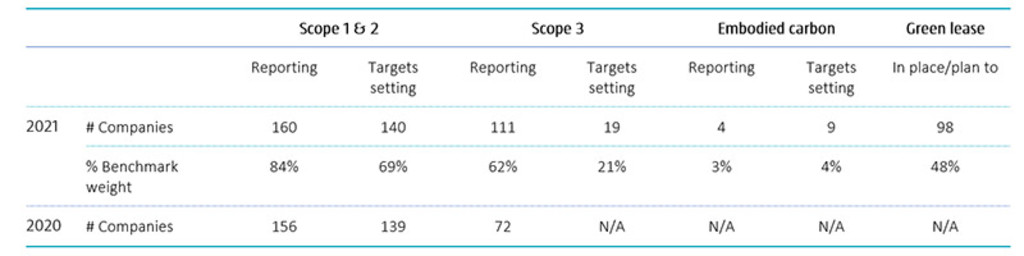

In this insight, we analyze data from companies invested in the Robeco Sustainable Property strategy and the top 200 largest listed real estate companies. For the first time, our analysis encompasses a wider range of metrics, now including scope 3 target setting, embodied carbon, and green leases2, as more companies have started disclosing information on these topics.

It is reassuring to see that in 2021, real estate companies in our sample, which account for 87% of the weight in the S&P Global Developed Property Index, and around 1.9 trillion USD in terms of market cap, have improving GHG emissions disclosure and targets, especially for scope 3.

Table 1 | Disclosure of environmental performance, targets, and use of tools to manage GHG emissions

Source: Corporate reports, Robeco.

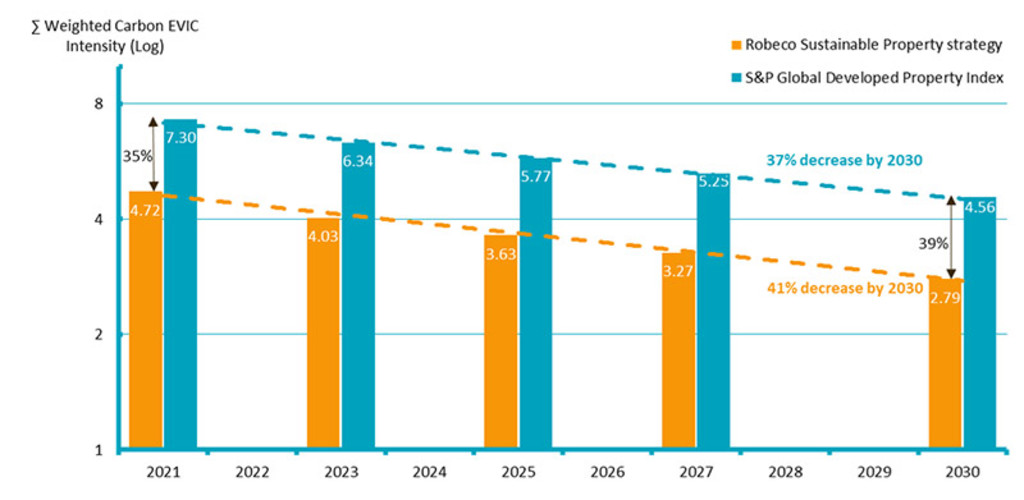

Based on the environmental performance and Scope 1 & 2 emissions reduction targets of the companies, we project the decarbonization pathway of the benchmark and Robeco Sustainable Property strategy for the coming years.

As shown in Figure 1, by employing proprietary RobecoSAM sustainability criteria in our stock selection, the strategy’s holdings had a 35% lower weighted carbon intensity (4.72) in 2021 than the S&P Developed Property Index (7.30), demonstrating that the strategy is already better positioned for decarbonization. In 2030, the strategy‘s holdings are expected to decrease their carbon intensity even further, reaching 2.79, compared to 4.56 for the index. While the strategy’s holdings are better prepared for future regulations, the overall reduction of emissions in the property sector has to accelerate to meet Paris agreement targets.

Figure 1 | Decarbonization pathways for the S&P Developed Property Index and Sustainable Property strategy

Source: Trucost, Corporate reports, Robeco.3

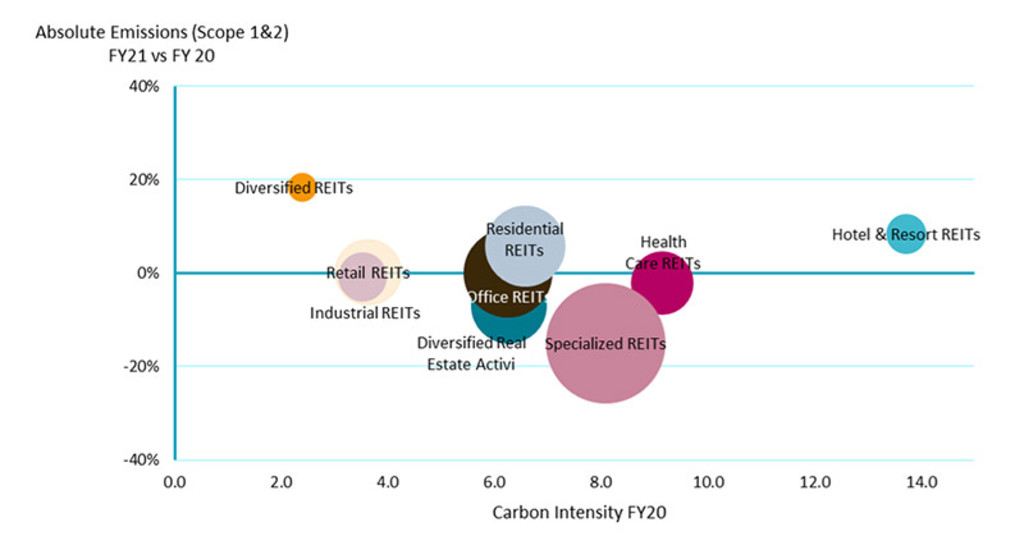

2021 progress

Our analysis reveals that companies in our sample decreased their carbon emissions by 4.7%4 over 2021. From a subsector perspective, the operations of some REITs that were hit hard in 2020, namely, Diversified, Hotel & Resort, and Residential, began to recover gradually when lockdowns were lifted, benefiting from rising vaccination rates and stimulus plans. As a result, we observed an increase in absolute emissions in these sectors in 2021. On the other hand, Specialized REITs where data centers constitute a significant part, have seen a decrease in emissions. With persistent robust demand for cloud computing and data storage, it is likely that the decrease has been driven by a reduction in carbon intensity rather than a decrease in operations.

Figure 2 | Absolute carbon emissions (scope 1 & 2) per segment, 2021 versus 2020

Source: Trucost, Corporate reports, Robeco.

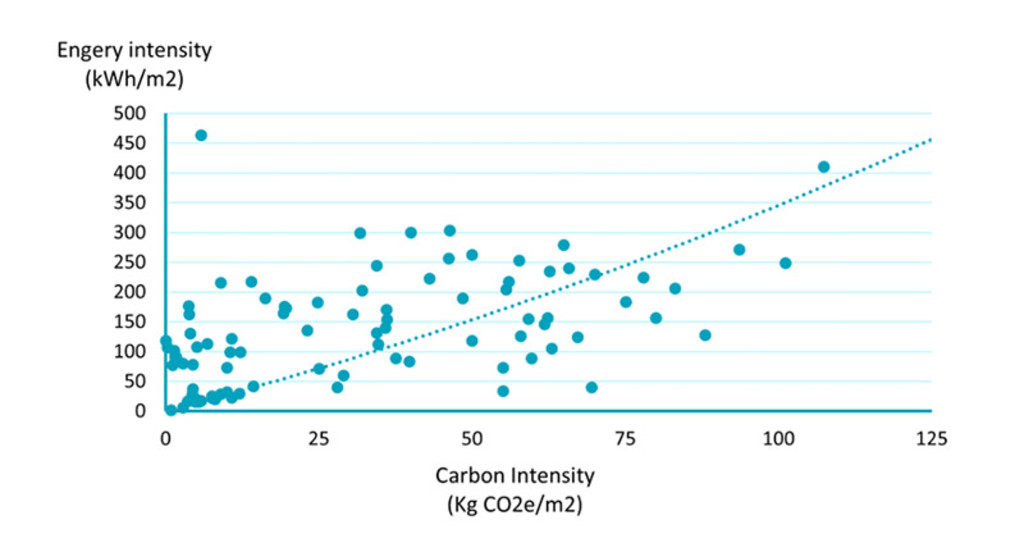

Energy intensity as another key factor in decarbonization

Reducing carbon emissions and improving energy efficiency are like two sides of a coin as illustrated in Figure 3. As the IEA emphasizes, “energy efficiency is one of the key ways the world can meet energy service demand with lower energy use, which is crucial in most of the IPCC GHG emissions pathways limiting global warming to 1.5oC”. 5

Figure 3 | Correlation between energy intensity and carbon intensity

Source: Corporate reports, Robeco.

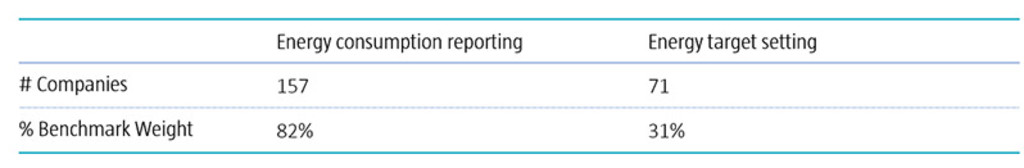

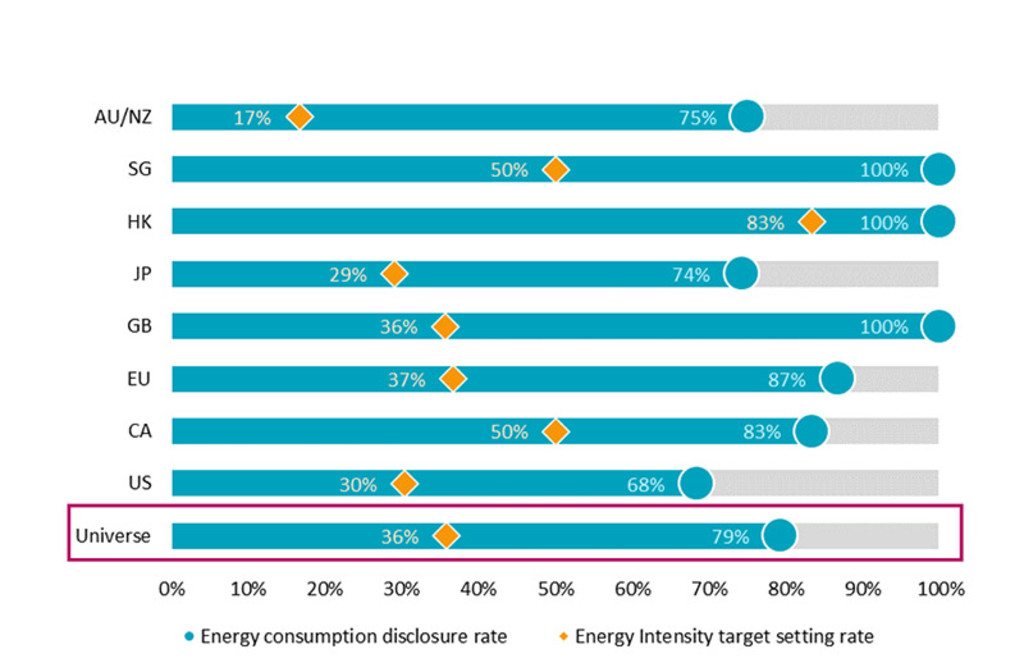

Table 2 presents that, in 2021, 157 companies in our sample, representing 82% of the benchmark weight, reported their energy usage, and 71 companies, representing 31% of the benchmark weight, set energy targets. However, a geographical analysis of the data (Figure 4) reveals notable variations, with Hong Kong (100%, 83%)6 and Singapore (100%, 50%) displaying higher levels of both energy use disclosure and energy intensity targets setting. Conversely, the United States (68%, 30%) and Australia/New Zealand (75%, 17%) appear to be lagging behind.

Table 2 | Disclosure of energy consumption and targets

Source: Corporate reports, Robeco.

Figure 4 | Energy use disclosure and target setting by geography

Source: Corporate reports, Robeco.

Energy consumption reporting and target setting is crucial. In the future, we expect binding minimum requirements of energy intensity per building to be set, with properties that fail to meet specific energy intensity levels no longer being able to be rented out, which will require large investments in retrofitting programs. While these requirements have yet to be formally imposed, related discussions are ongoing, and in some cases, energy ratings are already a prerequisite for leasing or building transactions.

Sustainable Property Equities D EUR

- performance ytd (31-1)

- 2.39%

- Performance 3y (31-1)

- -0.46%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

Footnotes

1 IEA data

2 Typically a green lease incorporates clauses obliging owner and the lessor to undertake actions and maintain standards with regards to subjects including energy efficiency measures, waste management or disposal, and resource-use efficiency.

3 A few assumptions are made in our calculation for the sake of comparability:

Assumption 1: If the emission targets disclosed in corporate reports are on an absolute amount basis rather than an intensity basis, it is assumed that the total floor area of the companies remains the same and the targets are treated as intensity targets.

Assumption 2: The base year and target year are uniformly set as 2021 and 2030 respectively for all companies. If a company has a target year close enough to 2030 (≤5 years), then that target is used as the 2030 target. Otherwise, the 2030 target is extrapolated by using the annual reduction rate.

Assumption 3: Carbon targets are only obtained for the companies in our sample, representing 84% of the weight in the S&P Developed Property Index, while the remaining 16% companies in the benchmark are treated to be decarbonizing in line with the rest of the sample. It is a conservative assumption, as smaller companies are generally at the very beginning of their decarbonization journey or have not yet started the process at all, therefore are less likely to have carbon disclosure or targets in place.

4 This number is derived from the analysis of scope 1 & 2 emissions of companies that have disclosure for both the years 2020 and 2021

5 IEA (2019), Multiple Benefits of Energy Efficiency.

6 The figures enclosed in brackets indicate the percentage of companies in the geography that reported their energy usage (first number) and set energy intensity targets (second number).