Increase allocation to Asia-Pacific value strategies

We believe now is the time to increase your allocation to value strategies in Asia-Pacific equities to take advantage of China’s re-opening and growth push, a US dollar that is likely peaking, the region’s strong structural backdrop, and solid monetary and fiscal foundations relative to the US and Europe.

Summary

- China re-opening will be another tailwind behind Asian economies

- We believe pivoting to Asia value over growth will offer better returns as economies recover

- Valuation gap with US still significant and Asia is likely to benefit from increasing flows

Asia-Pacific equities have seen resurgent performance since we highlighted they were under-owned back in September 2022, but the significant valuation gap with US equities still exists, even if it has narrowed slightly from its most extreme levels. Global investors still remain underweight both emerging market and developed market Asia-Pacific equities. With China’s 180-degree policy shift towards a re-opening and growth stance, earnings likely to be resilient, commodity exposure, and local currencies with room to appreciate against the USD, we think the window of opportunity to increase your investment allocation to Asia is very much open.

We were already positive on the outlook for ASEAN economies in 2023, but the anticipated recovery in China’s economy has cemented that conviction. Apart from specific re-opening opportunities like casino stocks, travelling business people and tourists from China will give a boost to economic activity across the region. The consumer space in Asia offers exciting long-term winners that will grow with an increasing shift towards consumption in the region, and this post-Covid period will just be the start.

The next phase of the upward move in ASEAN equities is likely to be driven more by fundamentals, especially earnings, rather than short covering, so it is critical to remain vigilant on stock specifics. ASEAN continues to look attractive structurally and in Vietnam and Indonesia we are looking again at several of the stocks that we like but had held back from, given historically higher valuations. In addition, Asia’s technology value chain, driven by the Internet of Things, 5G and AI remains attractive, alongside some banks and financials as loan growth recovers.

We also believe commodities exposure is an important element of allocating to Asia-Pacific, with mining names likely to be long term beneficiaries as China and the region gather post-Covid momentum. Metals including copper and iron ore (Australia) and nickel (Indonesia) are important to have exposure to, with China now consolidating its strong position in the vehicle electrification1, renewable energy, and battery technology industries, driving a renewed commodity cycle.

Valuations: The gap hasn’t closed much

While Asia-Pacific equities have enjoyed a decent recovery as the direction of China’s Covid and economic policies became clear, the valuation gap with the US has not closed much as US stocks have rallied too. In previous recovery cycles, post the dotcom bubble and after the global financial crisis, this kind of gap (Figure 1) has heralded a strong and long period of outperformance for Asia-Pacific.

Figure 1: Price Performance between MSCI Asia Ex Japan Index and S&P 500

Source: Source: MSCI, Bloomberg. Data range: Dec 2000 to Dec 2022

We are at just such a set-up now but with economic fundamentals across ASEAN stronger than in 2008, China recovering, and India’s growth trajectory making it a more important trading partner for regional economies.

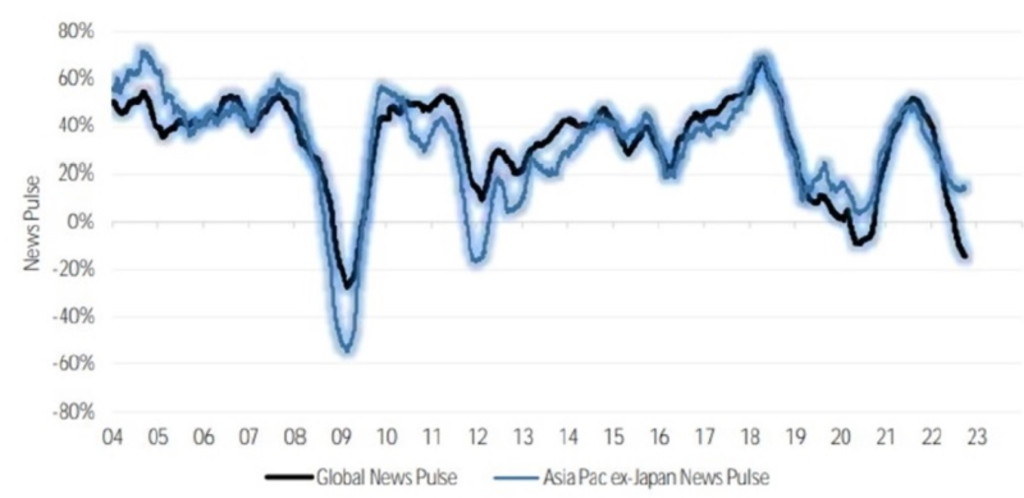

News pulse sentiment in Asia Pacific has diverged from a gloomy globe

According to news pulse data below, sentiment was already much more positive in Asia than the rest of the world before China’s re-opening. This has been offset to some extent by the mild winter in Europe and softening inflation in the US helping confidence in those markets. This calm period in the US and Europe may not last though and we think economic fundamentals will help sentiment diverge more in Asia’s favor, particularly given the strong data readings from China2. When we see a bottoming in the US PMIs, Korean and Taiwanese technology names may benefit more than those in the US given they are already close to floor levels.

Figure 2: News pulse in Asia ex-Japan remained in positive territory

Source: Bank of America Quantitative Strategy, MSCI ExShare, Ravenpack

Japan transitioning from deflation

There exists a powerful, structural earnings growth story in Japan, which has good potential to extend many years into the future. Japan is no longer simply a “value play” or a “leveraged play on global growth” – which are the views still held by many casual observers. Indeed, the more constructive outlook for prices and wages we are now seeing adds to our long-term optimism. We believe that Japan has exited structural deflation and suspect the Bank of Japan is gradually becoming more comfortable with this idea. The BOJ is however keen to avoid dislocation in bond and currency markets and wants to move incrementally. In the near term we believe this implies some volatility in Japan’s equity market, and while confident on the long-term outlook we are maintaining our current level of exposure within our Asia-Pacific equities strategy as this process plays out.

India is fully valued

Despite a weak finish to 2022 for Indian equities, the country with the world’s largest population3 had been feeling confident given it’s the fastest growing G20 economy, helped by cheap Russian oil imports, and has won some significant long term manufacturing business from Apple. However, with the Adani Group clash with short sellers still playing out, this highlights the risks with historically high valuations, and we believe earnings expectations are more than priced-in. While we are always looking for opportunities, we remain underweight and our value approach means we won’t be increasing our India exposure in the near term.

Value over growth

The key focus for our portfolio construction in Asia is to avoid pure proxies for US consumption, and stocks that trade at valuations comparable to peers in the US. Within the Asia Pacific equities universe, we continue to identify companies whose share prices do not reflect the company’s true potential and we believe will re-rate to a higher level.

With a selection of the world’s fast-growing economies in our Asia-Pacific universe, a blend of developed and emerging markets, we strongly believe allocation to Asia in 2023 is a sensible way to diversify away from elevated risks in the US and Europe.