Corruption is endemic to varying degrees around the world and as a crime is as old as time; it was first recorded as being present in the judiciary of the Egyptian First Dynasty of 3,100 BC. 1 It tends to be more common in emerging markets that have poor regulation or malfunctioning governments and judicial systems, though it has been seen in the West, typically when government officials have been bribed to award contracts. In one of the world’s largest corruption cases in 2006, UK defense contractor BAE Systems was accused of using bribes to sell arms to countries including Saudi Arabia, Tanzania and the Czech Republic, and paid GBP 300 million pounds to the US and UK authorities to settle charges.

Each year, Transparency International publishes a list of the world’s most and least corrupt countries based on its Corruption Perception Index.2 The index draws on a wide range of surveys and sources including the African Development Bank Economist Intelligence Unit, the World Economic Forum, World Bank and World Justice Project. The index has been published since 1995 and is widely used by investors, including Robeco’s Country Sustainability Ranking (CSR).

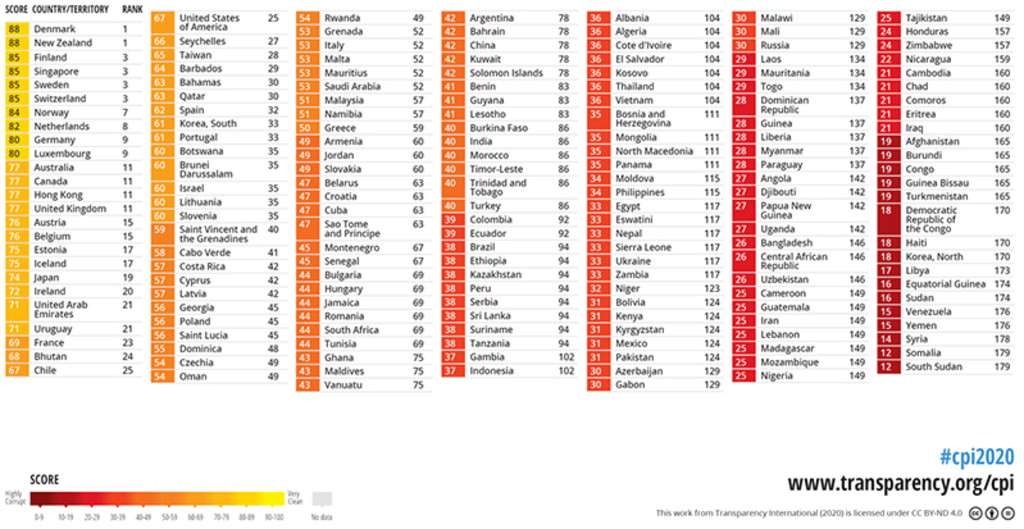

The most recent index published in January 2021 ranks 180 countries on a scale from 0 (highly corrupt) to 100 (completely clean). It named the most corrupt countries in the world as Somalia and South Sudan, which both scored 12/100. Somalia has been embroiled in a civil war since 1991 and does not have a functioning government, judicial system or police force. South Sudan became the world’s newest country when it gained independence from Sudan in 2011 following decades of civil war between north and south. It then became embroiled in its own civil war due to infighting between different ethic groups, though signs of stabilization were seen in 2020.

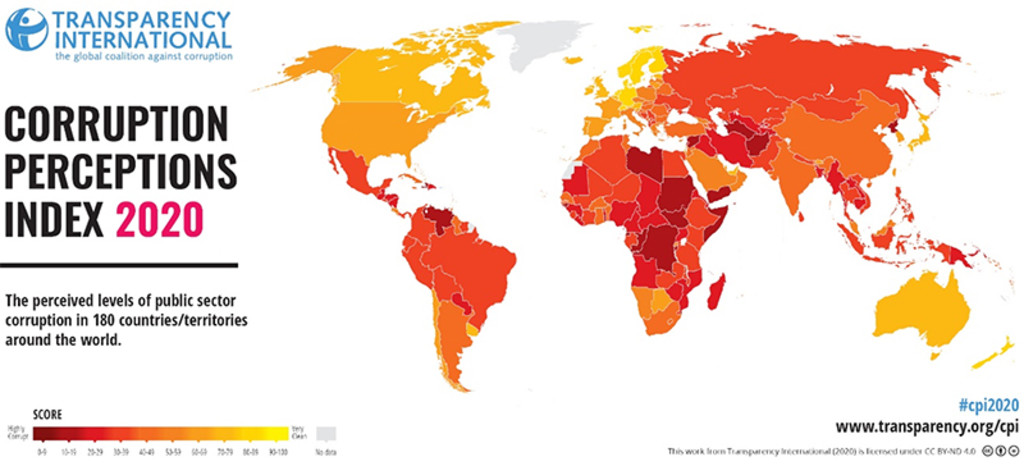

The world’s most and least corrupt countries in 2020

Source: Transparency International.

The four next lowest-ranked countries – Syria, Venezuela, Yemen and Sudan – have significant civil wars or internal uprisings that have stymied normal governmental practices. North Korea ranks ninth from bottom.

The ranking of countries according to their perceived corruption levels

Source: Transparency International.

What are the most sustainable countries in the world?

The world’s least corrupt countries are seen as Denmark and New Zealand, which both scored 88 points in the 2021 ranking. The highest ranking emerging markets are the United Arab Emirates and Uruguay, both with 71 points. The US is a surprising outlier among the developed nations in 25th place, ranking below Bhutan and Chile.

That ranking is very similar to that of the most recent Control of Corruption ranking of the 2021 Worldwide Governance Indicators (also published annually since 1996), which sees Denmark, Finland, Singapore and New Zealand at the top and Yemen, North Korea, Equatorial Guinea, Syria and South Sudan at the bottom.

See also: