Renewable energy is derived from sources that are naturally replenished, and can therefore continue to generate electricity subject to natural conditions. It differs from sources of energy that are finite and will eventually run out, led by fossil fuels, which cannot be replenished once extracted.

Sources of renewable energy

There are two ways to invest in renewable energy: either by buying the equities or bonds of the electricity or utility companies supplying the energy, or of the companies making components for the equipment that is needed to create power. This can be done through strategies such as the Robeco Smart Energy and Smart Mobility strategy, which specifically target this sector.

There are five principal sources of renewable energy:

Creating returns that benefit the world we live in

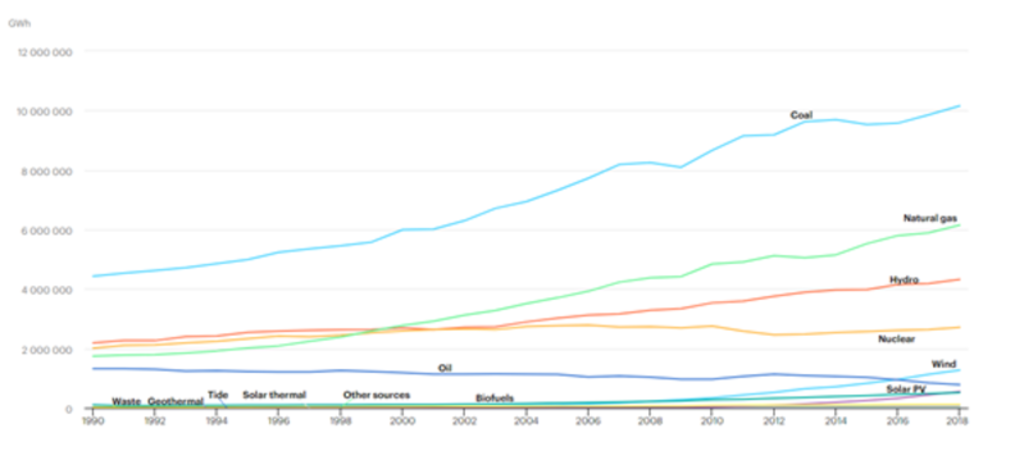

Energy generation by source: coal remains the world leader, while hydro is third.

Source: IEA

New sources of energy

One source of renewable energy that has the potential to be tapped is tidal power. This is a form of hydroelectric power that spreads barrages across river estuaries to harness the tide coming in and out. However, this requires a much larger geographical reach than a dam to tap into tides, and is much weaker than water continuously flowing through a dam or over a waterfall.

There is also growing interest in green hydrogen. Water is broken down into its component parts of hydrogen and oxygen using electrolysis that is powered by electricity drawn from renewable sources. The hydrogen that is released can then be used to power fuel cells that could replace internal combustion engines in the transport industry. However, large-scale electrolysis equipment is required to separate the hydrogen, making it much more expensive than other renewable sources at present.

Smart Energy I GBP

- performance ytd (31-1)

- 3.76%

- Performance 3y (31-1)

- 12.17%

- morningstar (31-1)

- SFDR (31-1)

- Article 9

- Dividend Paying (31-1)

- No

Meeting the Paris Agreement

The fact that virtually all sources of renewable energy are harnessed by turbines and not burned means they do not directly produce greenhouse gas emissions. They are therefore seen as playing a major role in achieving the levels of decarbonization needed to meet the Paris Agreement.

And renewable energy is growing in popularity. Once a niche industry, it has accounted for 28% of the world’s electricity generation in 2020, according to the International Energy Agency’s (IEA) Global Energy Review.1 Of this, 17% comes from hydro, 4% from wind, 3% from solar, 2% from biofuels, and 2% from other sources such as geothermal.

However, the sector also carries ESG risks, such as poor labor conditions in the mining of minerals needed for renewable energy equipment, and deforestation or land clearance in making space for large-scale solar parks.

Footnote

1Global Energy Review 2020