Gender equality is the concept of providing the same opportunities for men and women in the workplace, and has become a major sustainability theme.

It has three main dimensions:

The first is trying to improve the number of women on corporate boards, which remains disproportionately low in developed economies and can be virtually non-existent in emerging markets.

Secondly, it aims to ensure that men and women who do the same job receive the same pay. This is now a legal requirement in many countries, but gender pay gaps remain prevalent in many areas, often in high-profile jobs.

Thirdly, gender equality seeks to improve female (or male) participation in sectors where one gender is dominant. For example, most airline pilots are male, whereas the majority of cabin crew are female, leading many airlines to try to redress the balance through targeted recruitment programs. Other sectoral biases are more cultural, such as the high proportion of men in mining and women in textiles.

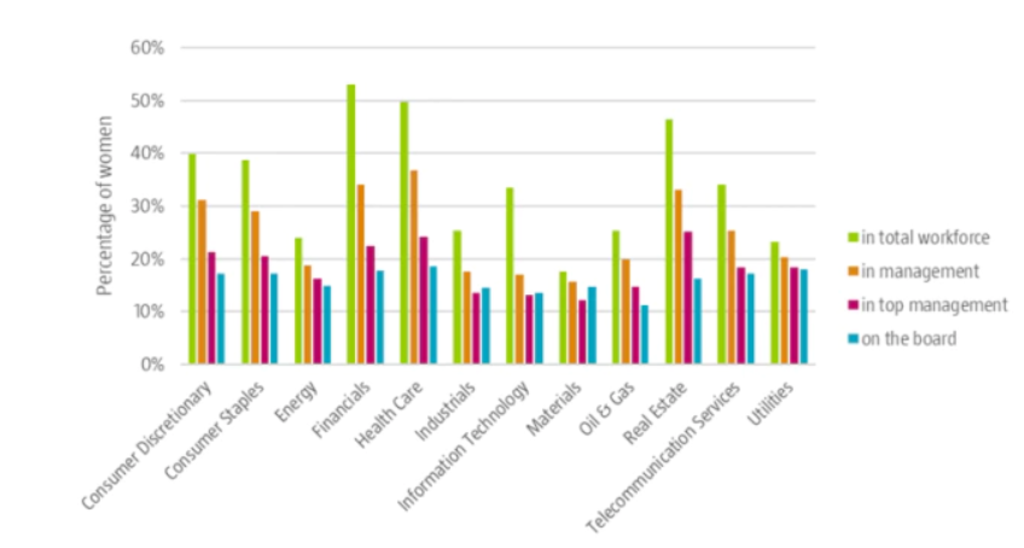

Female representation at different levels by sector in 2018.

Source: Robeco

Creating returns that benefit the world we live in

Addressing gender equality is a major engagement theme for Robeco, backed by the Robeco Global Gender Equality Impact Equity strategy, one of the few in the world to target it. The scale of the task is formidable, but there are an increasing number of international initiatives to progress gender equality along with women’s rights. To try to increase female board participation, Robeco belongs to the 30% Club, which aims to see women accounting for 30% of the members of all company boards across different markets. Appointing more women to non-board managerial positions is another objective, particularly after Robeco research showed that companies with higher proportions of female managers were more profitable.

It is a long haul – closing the gender pay gap will take 22 years at current rates, the research shows, although there have been some successes, particularly in high-profile cases at large organizations. Changing the gender balance in sectors has tended to be more company specific and sometimes involved deliberately changing recruitment policies to make it more attractive for either gender to join the firm, including the offer of better childcare provision or more flexible working policies.