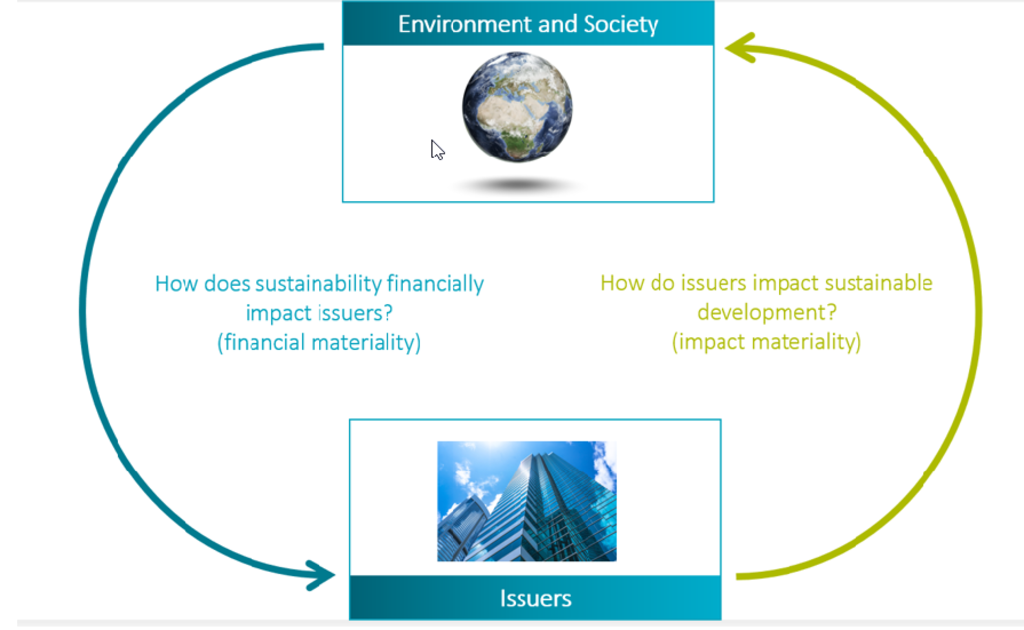

Double materiality measures the impact that the company has on the world alongside the impact that the world has on the company. The phrase was coined in 2019 by the European Commission which said:

“EU sustainability reporting standards need to be consistent with the ambition of the European Green Deal and with Europe's existing legal framework, the Sustainable Finance Disclosure Regulation and the Taxonomy Regulation. They need to cover not just the risks to companies but also the impacts of companies on society and the environment (the so-called ‘double materiality’ principle).” 1

It has been given a much higher priority as investors and society at large become more concerned about the impact that companies have on the wider world, and the environment in particular. Measuring such impacts is key to implementing EU initiatives such as the Green Deal, which targets a 55% reduction in greenhouse gas emissions compared to 1990’s levels by 2030.

A core focus has therefore been on emissions; how much carbon does a company generate while making or supplying its product or service? An energy company may well be an attractive investment, but its operations will add to global warming. This needs to be factored into the investment decision-making process, particularly as investors pursue net-zero targets.

Plastic pollution is a similar issue. A company could make a lot of money from producing or using single-use plastic, but it comes at a clear cost to the environment. A regulatory backlash and changing consumer tastes are forcing companies to rethink the effect they have on the world.

How do companies and countries score on sustainability?

Explore the contributions companies make to the Sustainable Development Goals and how countries rank on ESG criteria.

A changing world also affects businesses

Similarly, the effect that the world has on the company can produce both investment challenges and opportunities. Conflict areas have made it more important to assess whether supply chains contain materials from war zones, while advances in technology frequently upend company operations, such as the shift away from physical to digital products. Climate change and adverse weather patterns are also affecting sectors such as insurance, real estate and tourism.

Financial materiality and impact materiality would be completely aligned if all external costs were internalized by companies and countries. Currently, however, there are hardly any economic frameworks that can be used by investors to calculate external social and environmental costs that companies should internalize.

And it remains to be seen whether this will ever be possible – how can you put a monetary value on human life or the availability of clean water? Some argue we should not even try to give everything a monetary value. Subsequently, including double materiality in financial and economic frameworks will be a challenge for the financial industry for years to come.