Solution

When it comes to aligning a portfolio with a net-zero 2050 ambition, an important aspect to consider is the forward-looking portfolio profile of the carbon footprint. Forward-looking climate analytics, such as the Robeco Paris Alignment Assessment (based on our ‘traffic light’ system, which assesses a company’s degree of alignment with a below 2 °C scenario), play an important part in this.

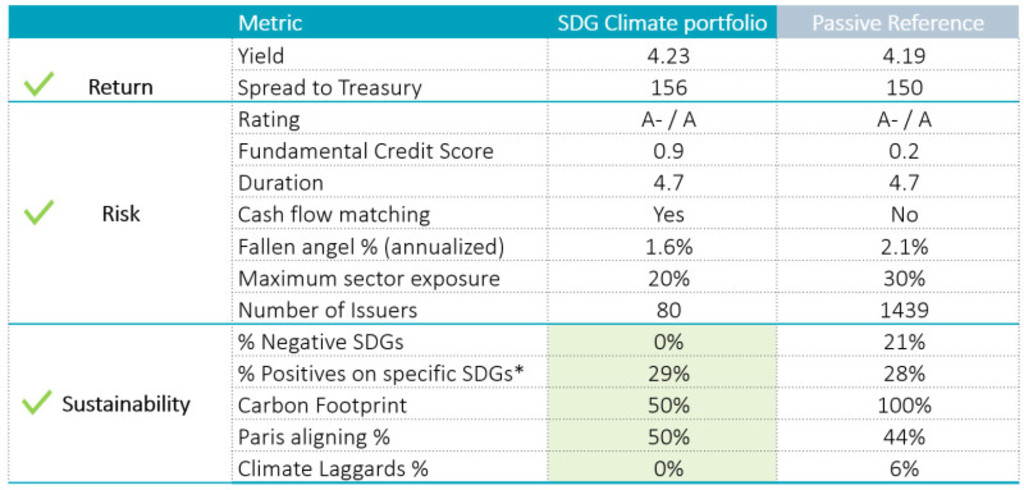

The portfolio in this case study needs to limit the number of fallen angels, match the target cash flow, uphold a minimum rating, have an optimal spread, maintain low capital requirements, make an impact across the SDGs and limit the current and future carbon footprint.

After an in-depth client consultation, we constructed a portfolio that balances the client’s various risk, return, regulatory and sustainability criteria. Figure 1 illustrates how this portfolio measures up versus a passive reference across a range of metrics.

The SDGs can be used to further generate a targeted impact on specific investors’ sustainability objectives through alignment with a specific set of the UN SDGs. Also, by allocating solely to companies that score positively on the SDGs, an SFDR article 9 portfolio can be created.