Fixed income

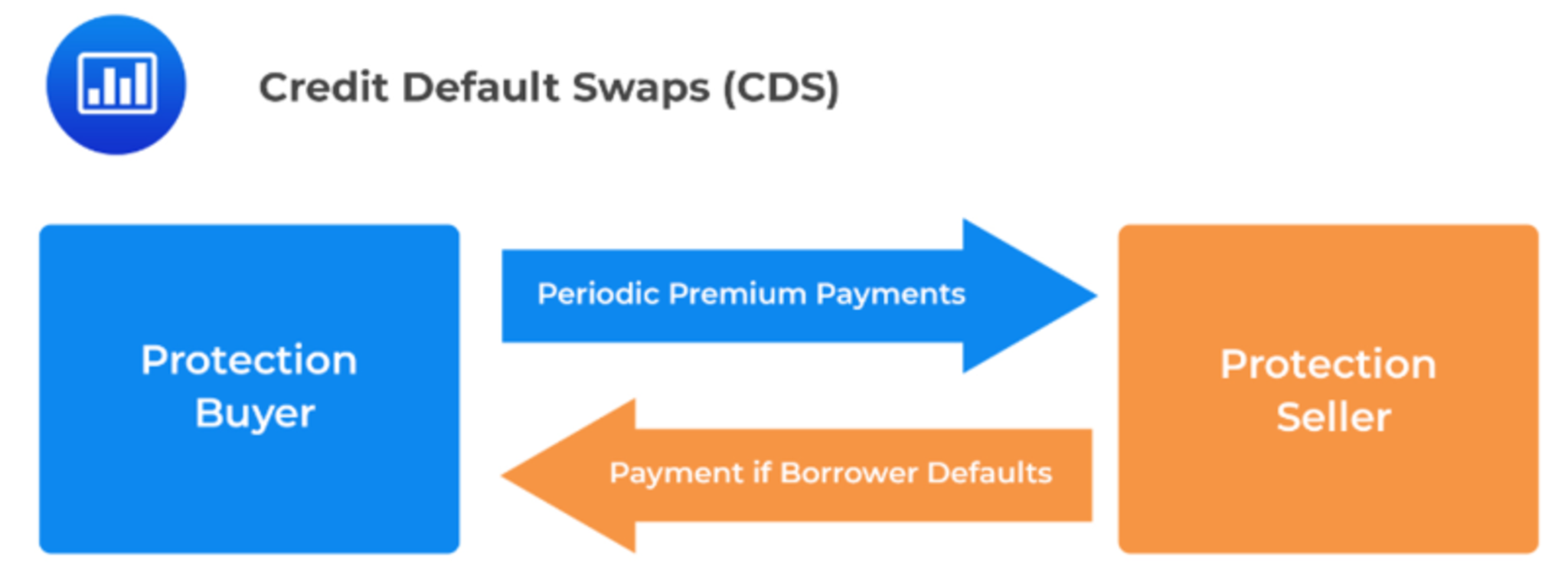

Credit default swaps (CDS) are financial derivatives that function as a type of insurance against the risk of default on debt securities, such as bonds or loans. It can be thought of as insurance against credit risk. In a CDS agreement, the buyer pays periodic premiums to the seller in exchange for compensation if the underlying debt issuer defaults or experiences a credit event, like a downgrade.

CDS contracts

CDS contracts allow investors to manage credit risk by transferring the potential losses to another party. They can also be used for speculative purposes, allowing investors to profit from changes in the perceived credit risk of an entity. The value of a CDS depends on factors such as the creditworthiness of the underlying issuer, market conditions, and the terms of the contract.

Also read