Low valuation stocks

Low valuation stocks outperform high valuation stocks.

Highly flexible unconstrained value equity strategies

Strategies ranging across different market capitalizations: all cap, large cap and mid cap

Diversified bottom-up portfolios run by a stable and experienced team of investment professionals

Companies with exciting growth stories can lure investors, while those that receive little fanfare can deter them. The resulting optimism about glamour stocks and pessimism about their Value counterparts give rise to the Value premium. That is where Boston Partners, sub-advisors to these strategies, demonstrate their exceptional strength as value equity specialists.

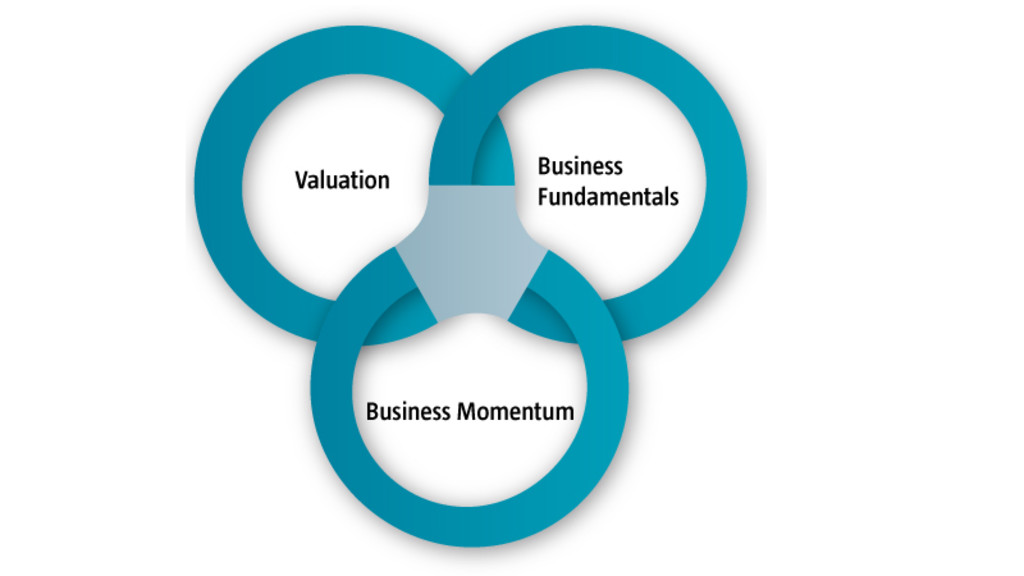

Our investment philosophy is grounded in certain ‘fundamental truths’ that apply to investing:

Low valuation stocks outperform high valuation stocks.

Companies with strong fundamentals (high and sustainable returns on invested capital) outperform companies with weak fundamentals.

Stocks with positive business momentum (rising earnings estimates) outperform stocks with negative business momentum.

We construct well-diversified portfolios that consistently reflect these three characteristics – which we call three circles - applying simple rules that aim to limit downside risk, preserve capital and maximize the power of compounding.

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content:

Boston Partners portfolios are built from the bottom up. The process begins with quantitative scoring and screening to cull a target-rich subset universe, based on the three circles. We cast our net wide, scoring over 10,000 stocks worldwide every week, which enables us to efficiently identify bona fide candidates and provides a road map for our fundamental research. This analysis incorporates the full menu of public filings, industry information and management discussion.

Long-term advantage can be obtained by remembering the obvious rather than straining to grasp the esoteric, by trying to be ‘not stupid’ instead of overly intelligent Charlie Munger

A centralized research team of fundamental and quantitative analysts supports the portfolio managers and the firm’s value equity discipline. Portfolio managers are the final decision makers and every investment professional is accountable for the holdings in our portfolios.

These strategies are sub-advised by Boston Partners, like ourselves a fully owned subsidiary of ORIX. They are a value equity specialist founded in 1995 by experienced professionals who had worked together for many years.

The strategy is available in the following investment regions: global and US.

This strategy promotes, among other characteristics, environmental and/or social characteristics, which can include exclusionary screening, ESG integration, ESG risk monitoring and active ownership. It is classified as Article 8 under the EU Sustainable Finance Disclosure Regulation.

Standing firm in our investment process and trading carefully

Leaning towards stocks that are attractively priced relative to their fundamentals

This has been a core expertise for us for decades

Managed by an experienced team with deep expertise