Why European industrials deserve a closer look

Higher spending on real assets is making European industrials increasingly attractive, says value investor Chris Hart.

Summary

- Europe is benefiting from investment in infrastructure and defense

- Industrials offer attractive valuations with good growth potential

- Sector diversifies away from the Big Tech firms’ concentration risk

It follows investor unease about lofty valuations in US equities that have become dominated by the Big Tech firms, leading many to seek opportunities elsewhere. Chris Hart, portfolio manager of Robeco BP Global Premium Equities, sees ample opportunities in a number of market segments outside the US – particularly in Europe.

“Big US Tech is both expensive and capital intensive,” says Hart. “Capital expenditures – specifically on artificial intelligence (AI)-related investments – have grown dramatically for large technology companies in a relatively short period of time.”

“The return on these significant investments remains to be seen, as does the persistence of investor patience in waiting for those returns. Any weakness in earnings or growth may translate into a swift repricing for the segment, as evidenced in April 2025.”

As a leading value investor, Boston Partners employs a time-tested investment approach that seeks to identify fundamentally solid companies that are trading at attractive valuations and experiencing positive business momentum.

Although valuations in many segments of the US equity market are above historical norms, the Boston Partners team has been finding no shortage of quality companies overseas that meet their criteria – particularly in European industrials.

“We believe the European industrials sector today sits at the intersection of several powerful global trends, from new government spending initiatives to structural shifts in technology and supply chains,” says Hart.

Boost from defense spending

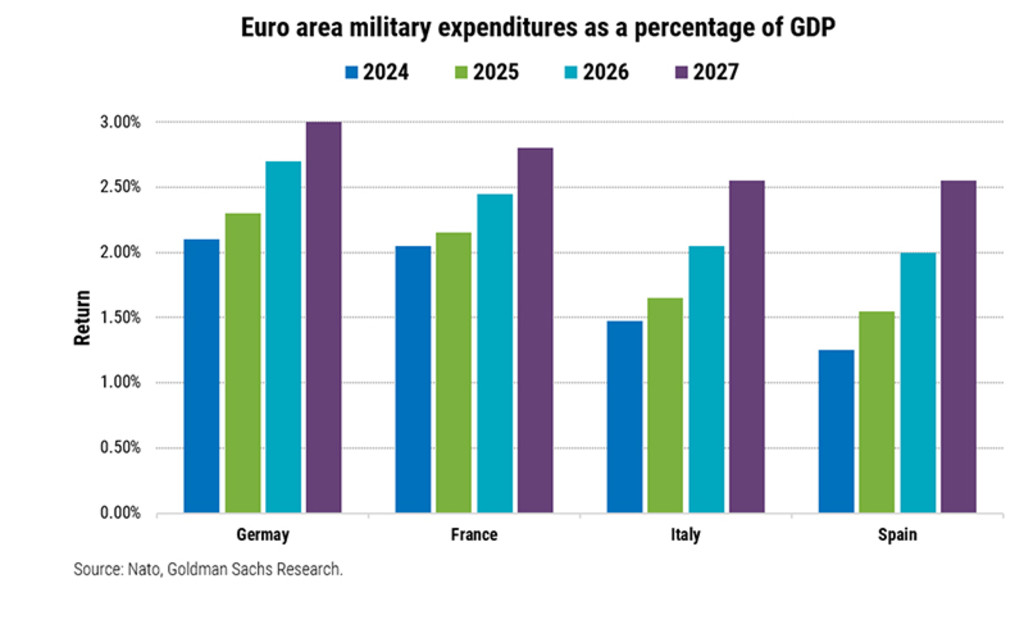

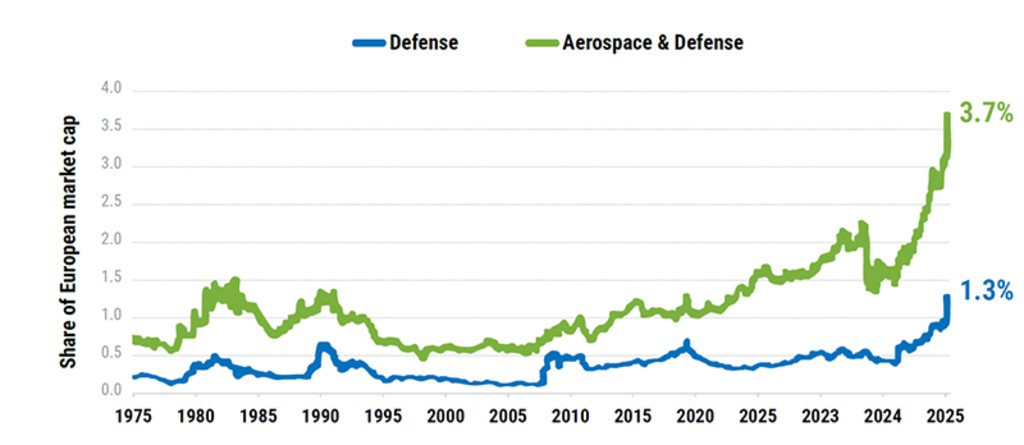

“This is especially true within the aerospace and defense segment, where higher defense spending intentions and rising infrastructure stimulus are expected to provide a substantial boost. With European and Canadian NATO outlays expected to rise from 1.7% of GDP in 2022 and 2.0% in 2024 to a pledged 3.5% on ‘core defense requirements’ by 2035, the growth runway is significant.”

“In addition, a greater allocation of spending toward European-made equipment should help buttress regional manufacturers and create more durable long-term demand across the continent.

“Germany’s announcement of a EUR 1 trillion spending initiative marks a historic departure from its traditional fiscal conservatism and highlights how political consensus is shifting. Similar trends are emerging in the UK and France, where bipartisan support is coalescing around investment in infrastructure, defense, and green technologies.”

“This pivot in public policy represents a powerful tailwind for industrials more broadly given the newfound financial backstop for multi-year projects that require capital goods, engineering services, and construction-related activities.”

Figure 1: Military spending is seen rising in leading European economies

Source: Nato, Goldman Sachs, November 2025

Benefiting from AI

The AI rollout is boosting both supply and demand for industrials companies. “Beyond defense and infrastructure spending, the electrical equipment industry in Europe is also benefiting from transformative demand drivers,” says Hart.

“The global buildout of AI data centers is accelerating the need for advanced electrical systems, while the transition to new energy solutions – from renewable integration to grid modernization – is providing an additional layer of durable growth.”

“These trends are creating opportunities for companies that can supply high-efficiency power solutions, advanced components, and more modern technologies. At the same time, automation and AI tools are reshaping how industrials businesses operate.”

“Companies that are deploying advanced automation tools, AI-driven process optimization, and digital supply chain management solutions are gaining measurable efficiency advantages. These innovations streamline workflows, reduce administrative burdens, and improve both operating margins and global competitiveness.”

Figure 2: Aerospace and defense is rising as a proportion of European market value

Source: Goldman Sachs Research, “Defense spending to boost German and European GDP growth,” March 19, 2025.

BP Global Premium Equities D USD

- performance ytd (31-1)

- 4.01%

- Performance 3y (31-1)

- 17.00%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

Some additional tailwinds

Resilient global trade, increased investment, and good capital discipline all act as additional tailwinds for the sector. “Growth in the industrials space doesn’t occur in a vacuum,” Hart reminds investors. “The sector remains deeply linked to global trade, capital investment and infrastructure activity – areas that tend to accelerate during periods of macroeconomic strength.”

“We believe this cyclical sensitivity, when paired with long-term secular tailwinds, positions the sector well for both near- and medium-term growth. Supply chain reshoring initiatives, the ongoing energy transition, and a steady pace of efficiency improvements are reinforcing the underlying strength of the sector.”

“That said, US trade and tariff policies remain an area worth monitoring closely, but the data so far suggests that global trade has been weathering the increased cost of doing business with the US.”

Looking for real value

At the end of the day, it still boils down to picking the right stocks for an investment portfolio. “An important differentiator within industrials lies in capital efficiency,” Hart says.

“We look for companies that consistently deliver high returns on invested capital (ROIC), which, when coupled with healthy balance sheets and robust cash flow generation, not only lends financial resilience during downturns, but also allows for organic investment, attractive shareholder returns and accretive acquisitions.”

For investors concerned about mounting concentration risk in US equities, Hart believes these dynamics paint a constructive picture for the European industrials sector.

“Given the structural growth opportunities in defense and energy infrastructure – paired with disciplined capital allocation and potential efficiency gains from automation – we believe European industrials offer underappreciated upside potential at attractive absolute valuations.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.