The secret of Select: Finding value from the bottom up

It’s all about stock picking. That’s the secret recipe of one of Robeco Boston Partners’ most successful strategies that has consistently outperformed difficult markets.

Summary

- US Select Opportunities Equities strategy enjoys years of outperformance

- Focus on bottom-up investing using the ‘three circles’ philosophy

- Valuation discipline with a quality bias finds the best picks

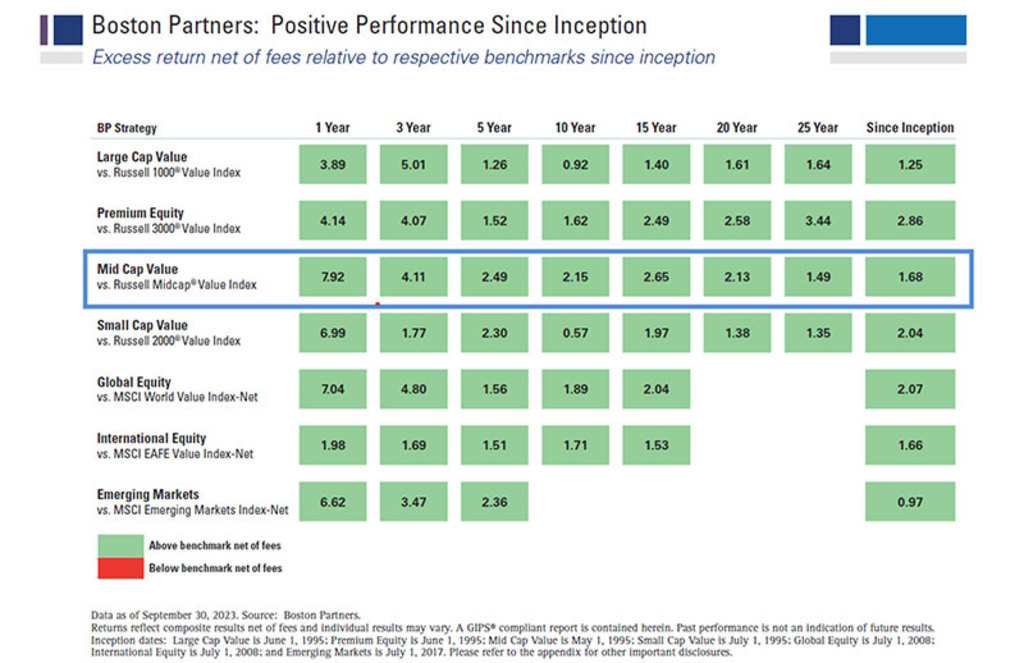

The US Select Opportunities Equities strategy has enjoyed benchmark-beating returns across all timeframes since its inception as a UCITS investment product in 2011, and since the inception of the underlying US Mid-Cap Value strategy in 1995. It looks for mid-cap stocks with a market value of between USD 2 billion and USD 50+ billion, with an average portfolio value of USD 23 billion.

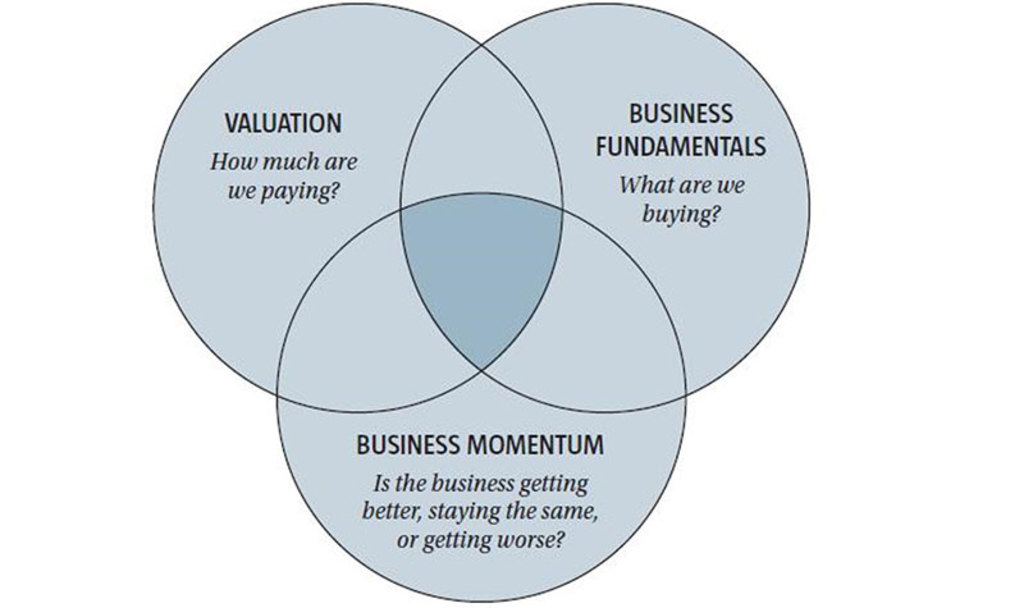

Value investing is the practice of looking for stocks whose share price does not reflect the intrinsic value of the company. To find these stocks, Boston Partners uses the tried and tested ‘three circles’ philosophy. A company must have good fundamentals, strong business momentum, and a valuation that allows for upside.

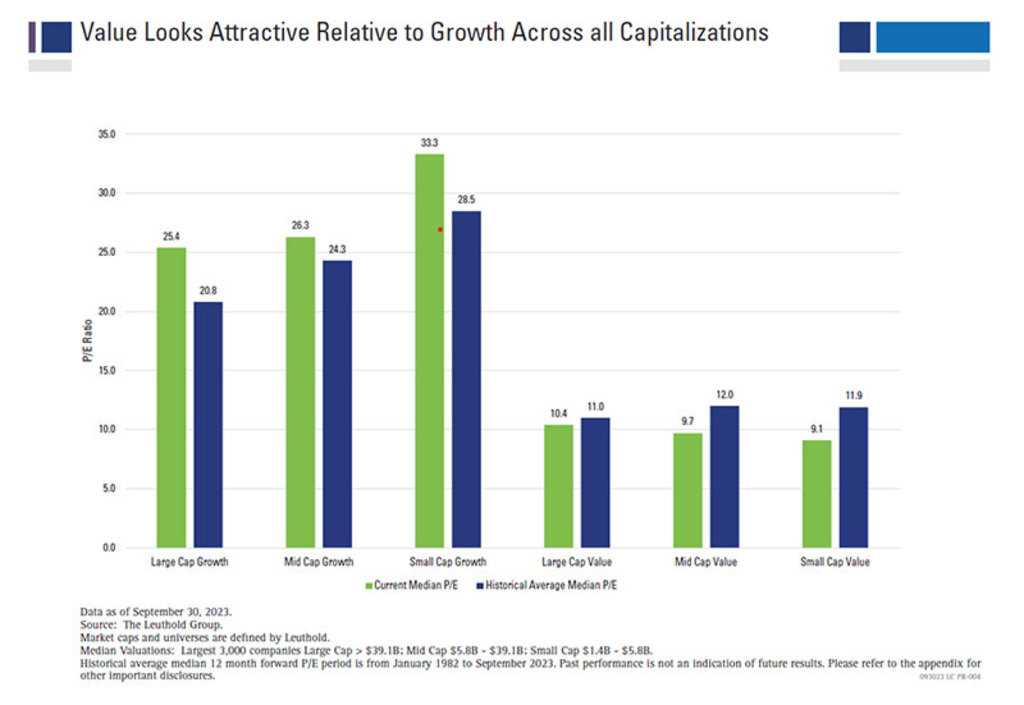

Certainly, the current economic conditions are ripe for value investing, which typically does well following downturns, recessions, inflationary spirals, rate rises, or generally when everything in the garden isn’t rosy. Growth investing, by contrast, historically outperforms when rates and inflation are low.

The overall performance of the Mid Cap Value strategy over time. Source: Boston Partners.

But you can forget all that, says Portfolio Manager Tim Collard, who has little interest in predicting the macro factors that come from the top down, and instead focuses entirely on the bottom-up for portfolio construction. Put simply, this means picking the right stocks, avoiding the losers, and ignoring the background noise.

It has certainly worked for his strategy, which has lived up to its ‘Select Opportunities’ name and has risen in value by 10.73%, annualized, since the value rally began three years ago, compared to a 7.29.% rise in the benchmark. In the past year, the portfolio has risen by 4.86% when the main market fell by 0.75%, thereby delivering both absolute and relative returns.

True bottom-up investing

So, what’s the secret to this success? “We're always going to look to where the three-circle, bottom-up opportunities are and not make calls on the macro environment, rates, inflation, and so forth,” says Boston-based Collard. “What we do is true bottom-up investing.”

At the core of stock picking is sticking to the three-circle philosophy that has underpinned value investing at Boston Partners for four decades. Of the three circles, momentum is the one that is usually the most difficult to read.

“The three circle discipline is what we live and breathe, but there’s always an interplay between them, and a push/pull for each one,” Collard says. “We’d love to say that every stock we own meets the criteria for all three circles the day we own it, but that’s a rarity. It’s always a balancing act between them on an individual stock basis, while the portfolio is managed with a holistic three circles lens.”

“And while we're always mindful of what the three circles are telling us today, it’s more important to try to discern how the three circles will evolve in the future.”

The merits of momentum

“When we drill down into the three circles, we discuss the merits of the momentum circle evolving,” Collard says. “What is momentum today, and how may that change? It’s rare that the fundamental circle changes; business fundamentals are usually pretty durable, whereas the momentum factor and then inherently thereafter the valuation is a lot more dynamic.”

“We can buy stocks in which the fundamentals are excellent and the valuation is attractive, but where the momentum is challenging. So here, we need to work out if there is a catalyst for the momentum to change. We will not buy a weak momentum stock based solely on valuation and fundamentals; instead, we will focus on a pathway to momentum stabilization and/or improvement.”

“For many investors, it’s about investing in the present, but the present is already in the price. Price leads fundamentals, so by the time the momentum is flashing green, the stock’s already ahead of that. You need to be anticipatory.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Looking for quality within value

How this works in practice can be seen in buying companies that adhere to the core principle of value investing – its share price today does not reflect its likely performance tomorrow.

But care is needed to avoid the ‘value traps’, where stocks are cheap for a reason, often because of structural issues, poor management or return on capital, among other things. The quality factor is subsequently used to find stocks that offer value with upside, even if they’re down on their luck now.

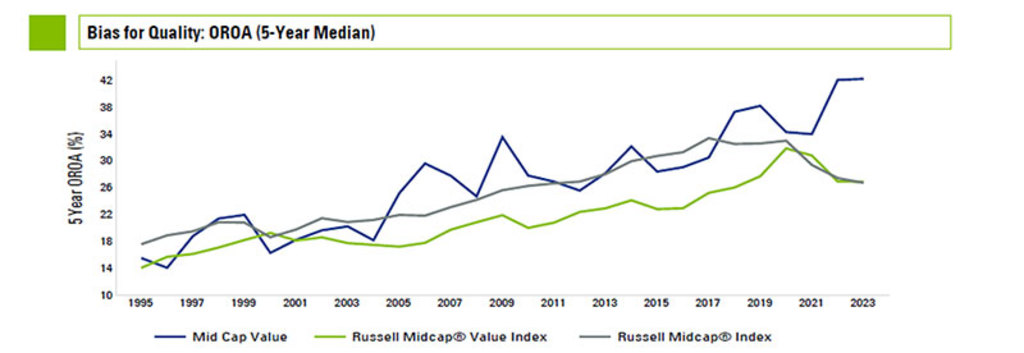

“Unlike some value managers, we have a quality bias, and that means our fundamental advantage versus the benchmark is quite profound. One of the metrics we look at within the fundamental circle is operating return on operating assets (OROA) – a measure of quality. Plus, we’ll avoid companies with high debt levels. We’re typically biased to less capital-intensive businesses, so we don’t get the one-two punch of both operating and financial leverage working against you.”

The strategy’s quality bias compared with the benchmarks. Source: Boston Partners.

“For example, we bought a home warranty company in 2022 that had been badly hurt by labor and product inflation, but we thought that this problem would prove transitory – plus we had the catalyst of a new CEO that could prospectively improve both the momentum and fundamental circles. It has since been a terrific investment and really underscores how we look for stocks.”

Will the value rally last?

So, if a recession is coming, which is traditionally better for value investing, will the current rally be extended? “These rallies are typically enduring,” Collard says.

Value relative to growth. Source: Boston Partners

“The resurgence in value really started in late 2020 when the Covid vaccines were first discovered, but there’s been some fits and starts. 2023 has been more challenging for value, and that’s probably a consequence of clear signs of disinflation and a pullback in interest rates.”

“But when we look at mid-cap value, it’s trading at a significant discount to the long-term average, whereas mid-cap growth stocks are trading at a premium to their historical average. This would lead us to believe that empirically, the odds are in our favor.”