Finding value within long-term thematic trends

It’s been man overboard for thematic investing as the style went out of favor in 2022. Steadying the ship means following the underlying trends that support key themes such as digital transformation and the green transition, says analyst Daniel Ernst.

Summary

- Growth-orientated themes were hard hit as monetary tightening kicked in

- Megatrends of innovation, demographics and preserving the Earth are intact

- Climate change presents huge opportunities in transformative technologies

No trend remained on dry land as thematic investing suffered its ‘annus horribilis’ and all but capsized in 2022. After rising eight-fold over five years and throughout 2021, the total value of thematically orientated assets under management tumbled by nearly a third.

Growth-orientated themes were particularly hard hit. After delivering annualized returns of 14.3% in the ten years leading up to and during 2021, the MSCI All World Growth Index fell 29.7% in 2022. In comparison, the MSCI Value Index generated 6.7% annualized returns in the ten years through 2021 and fell 8.8% in 2022. Sorting through this wreckage, we find that the fundamentals for broad structural themes across digital innovations, shifting demographics and the green transition remain buoyant.

So, what happened? Three key factors contributed to the steep correction. Firstly, valuations were high, as illustrated by the MSCI All World Growth index which started the year at 34 times forward earnings against a pre-Covid average of 21x. Secondly, after expanding 35% year on year in 2021, forward earnings growth estimates for the MSCI All World Growth index fell to 14% in 2022.

Thirdly, monetary policy began to shift from exceptional easing to aggressive tightening, with the Federal Reserve raising the benchmark interest rate seven times from near zero to more than 4% by the end of the year. In hindsight, the results were predictable – valuation multiples collapsed.

A dramatic shift in the narrative around underlying structural drivers also contributed to the pressures. The imbalanced view that Covid had permanently altered how people work and live, quickly shifted towards a consensus that everything would ‘return to normal’. Key trends, from e-commerce to software’s transition to the cloud, were all called into question as economies reopened and digital service growth slowed.

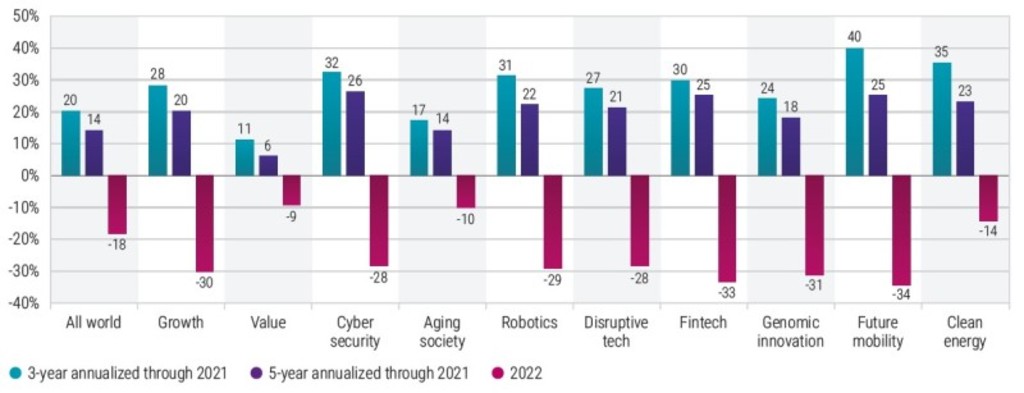

Consequently, the correction in 2022 impacted every major theme, from cyber security to clean energy, as shown in the chart below:

Thematic and style index performance. Source: Bloomberg, MSCI

A world of constant change

The impact of the kind of structural change as seen with Covid is rarely limited to any one sector or place, especially in the age of globalization. This is clearly the case with climate change, as the emissions from one country can spread across borders, and the most acute effects are unpredictable and seemingly disconnected. As a result, a systems-level approach is required to build solutions and identify structural winners.

For example, electric vehicles are comprised of a complex array of disciplines including chemistry, metallurgy, semiconductors, software, robotics and supply chain management. Finding the expertise to assemble and scale those disparate technologies, within the confines of profitable established business models, has proven a challenge for incumbents and entrants alike.

And while the impacts of structural changes and transformative shifts are broadly felt, there are typically few beneficiaries. Research showed that a typical stock listed in the US from 1926 to 2019 had a buy-and-hold return of minus 2.8% over its entire lifetime. Furthermore, out of 25,000 stocks listed between 1973 and 2020 in the US, just 13% achieved a return of 25 times the initial outlay over almost half a century.

And the market is becoming increasingly narrow. Another study examining the returns of 64,000 global stocks found that the top performing 2.4% of companies accounted for all of the USD 75.7 trillion in wealth creation between 1990 and 2020, led by the big tech companies.

Well-supported themes

Then there is the issue of looking at trends as a means of predicting the future, particularly given the new dominance of tech. While thematic portfolios can include an allocation to earlier stage ideas, the largest and most profitable opportunities often reside within trends that are already set in motion.

This can be seen in the three megatrends of transformative technologies, changing socio-demographics and the imperative to preserve the Earth as our planet faces unprecedented threats from global warming and biodiversity loss. All remain firmly intact, even if they themselves are subject to change from within.

For example, digital services – a sector that thrived during the pandemic – was among the hardest hit in the 2022 correction, and its growth slowed markedly as economies reopened. This led to a swift shift in the narrative from ‘everything has changed’ to ‘it’s all going back to normal.’ Covid winners were thrown into the bin like yesterday’s dot coms.

What to make of e-commerce

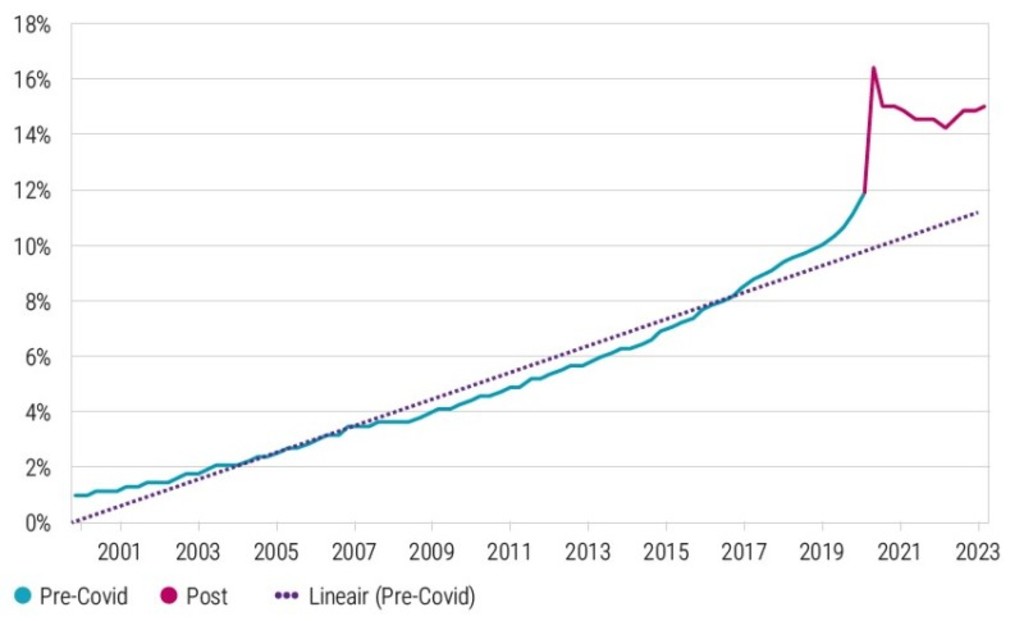

E-commerce is another shifting sand. In the years preceding Covid, e-commerce sales in the US expanded at a constant rate, reaching 11.1% of retail sales by the fourth quarter of 2019. During the pandemic, the share of e-commerce jumped to 16.4% of retail during the second quarter of 2020. As restrictions eased, e-commerce sales decelerated, and its share of retail revenue fell.

However, in subsequent quarters, share gains resumed, and in the first quarter of 2023, e-commerce accounted for 15.1% of retail sales, a level well above the linear regression forecast based on pre-pandemic data. This is shown in the chart below, where there is a clear mismatch in the Covid era:

US e-commerce sales as a percentage of total retail sales. Source: US Department of Commerce, May 2023

India as a sub-theme

Shifting global demographics also create opportunities and challenges across a broad range of sectors including energy, health care, nutrition, materials, security and supply chains. Diverging trends among countries will drive an important demographic milestone in 2023 as India is expected to surpass China in population, reaching nearly 1.43 billion people, and with a rising (and higher spending) middle class.

Notably, over the last ten years, the number of people in India without electricity has decreased from almost 300 million to just 30 million. Over that same period, the number of internet users has increased from 125 million to more than 800 million and the number of mobile cellular subscriptions rose from 900 million to 1.2 billion. Interestingly, while many of the west’s largest technology and internet companies are led by chief executive officers of Indian descent, the country has produced few global enterprises.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Climate change doesn’t change

Then there is the battle against climate change. Electric vehicles and renewable energy sources are increasingly, not only the most climate-friendly options, but the most economical. Battery-powered electric vehicles sales are soaring, while the average price of utility scale solar and wind power generation is 39% less expensive than gas and 67% cheaper than coal.

So, with these drivers intact, we remain optimistic that the fundamental shifts that power the three overarching megatrends will continue to drive future returns. Thematic investing continues to seek innovative and profitable businesses to address these disruptive forces and build value over the long term. We had a rough year, but the future is yet to come.

This article is an excerpt of a special topic in our five-year outlook.

Webinar: 5-Year Expected Returns 2024-2028

Our five-year outlook on market opportunities and risks.