Running a tight chip – is there relief in sight for semiconductor supplies?

Two years on, the global economy still grapples with a severe chip shortage, with no immediate end in sight.

Summary

- Industry caught off guard by booming pandemic demand

- Mid- to low-end consumer products (from autos to washers) hardest hit

- Smart energy holdings well positioned to benefit from chip squeeze

Semiconductor chips are necessary for all modern electronics – from smartphones to laptops. They are also at the core of many less sophisticated white goods like dishwashers, heating systems and point-of-sale devices.

The most prominent victims are automakers that have been forced to halt production in recent months, losing an estimated USD 210bn of sales in 2021.1 The shortage has also affected other industries like medical devices, networking equipment and game consoles. More recently, even the PC and smartphone industries blamed chip shortages for lowering output targets.2 Ironically, even companies making machines to produce semiconductor chips are suffering from shortages.

One key driver for the shortage is the sheer scale of demand after the Covid crisis that many in the industry underestimated. In 2019, chip sales fell by 12%, driven by the cyclical nature of memory chips. In late 2019, however, the Semiconductor Industry Association (SIA) predicted global sales growth of 5.9% for 2020 and 6.3% for 2021 – even before the pandemic hit the mainstream economy.3 Many market participants reacted to the Covid crisis by taking out their recession playbooks – cutting orders and reducing inventory. However, thanks to lockdown measures and government stimuli, the Covid crisis led to an unpredicted outcome – consumers and companies increased spending on digital goods and infrastructure. Accordingly, SIA saw semiconductor sales grow by 29.7% from August 2020 to August 2021, driven by demand for 5G phones and cloud infrastructure, but also in classic electronic goods like PCs, TVs and webcams.4

The Covid effect came in combination with secular trends in home appliances and cars becoming smarter, equipped with more chips than in the past (e.g., an electric vehicle uses roughly double the semiconductor content of a regular car). The digitalization of the economy in general (e.g., the shift to e-commerce and digital work) is also fueling a constant increase in the demand for chips. Unfortunately, even geopolitical actions had their impact: US imposed sanctions on Chinese technology companies (e.g., Huawei) in 2019 led to Chinese manufacturers hoarding chips to ensure supply.5

The chip industry has historically suffered from “boom-and-bust” cycles as well as “double ordering,” where clients buy more chips than needed. As supply and demand normalized and tightness in the chip market abated, demand dramatically declined. Based on past experience, most players in the semiconductor market were understandably reluctant to invest into more capacity to satisfy temporarily high demand without strong, long-term customer commitments. Even though TSMC, Intel and Samsung did eventually increase their investment in new fabs, these modern semiconductor plants cost more than USD 10bn each and take years to build as chip complexity increases.6 As a result, most invested capacity will only be available in 2023 or even 2024 – as most equipment makers have seen lead times stretch to more than 52 weeks (double the usual).

Highest margins win capacity

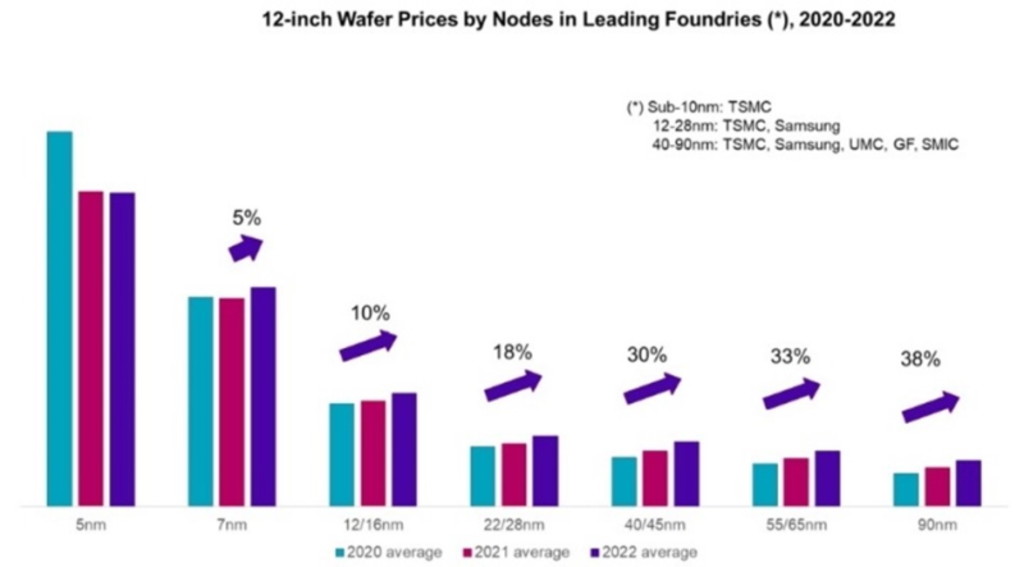

Capacity is generally only added at the leading edge, meaning fabs are built to produce the most modern semiconductors, as only these chips carry the profit margins required to amortize the high fixed capital costs. Over time, as chip technology gets commoditized, older chip designs (like those for less sophisticated automotive applications) also benefit from moving into this higher-end capacity. However, this is a long process and provides no immediate solution. For the time being, we currently face the unusual situation of legacy chips (40nm to 90nm nodes) used for automotive and white goods, feeling the squeeze, whereas capacity is mainly expanding for bleeding-edge nodes (5nm and 7nm).

Accordingly, chip manufacturers have reacted with selective price increases that reflect the tightness of the market at different node levels. Figure 1 illustrates price hiking mechanism of leading fabs across different nodes for 2021 and 2022.7

Figure 1 | Price increases for lower-end (legacy) chips

Source: Counterpoint Technology Research, Robeco

As Figure 1 demonstrates, price increases will continue into 2022, indicating continued imbalance of supply and demand for legacy chips. Therefore, we are not optimistic that the tightness in the semiconductor market will be resolved as quickly as some industry participants and investors expect. The pain might just shift to other areas of the market.

It may get worse

Several risks also loom in the highly consolidated global semiconductor supply chain. A Corona-driven lockdown in Xi’an, a leading manufacturing hub in China that is home to many memory chip component factories, meant supplies for semiconductor leaders, Samsung and Micron, were temporarily disrupted. Moreover, a fire at ASML’s optical production site in Berlin over New Year’s Eve may also impact its customers. Incidents like these could further exacerbate supply imbalances and inflate prices.

Several large technology companies are working hard to make virtual and artificial intelligence (VR & AR) mainstream, leading to potentially huge demand for smart glasses equipped with high-powered semiconductor content. The recent stronger push for a more carbon-neutral world often means a shift from “dumb energy” such as burning fossil fuels to “smart energy” like batteries, solar cells and wind turbines, all of which make heavy use of semiconductors to control and optimize energy production, storage and distribution. However, the history of the semiconductor industry indicates that once tension is released, the bust cycle will be, once again, at play.

The Smart Energy Strategy is overweight in analogue and power semiconductors driven by strong secular trends in electric vehicles and smart grids as well as the robust economic recovery. These should help increase utilization, tighten supply, raise prices and lead to continued higher profits even given inflationary pressure. However, as these factors are priced in, the Strategy has become more selective of its semiconductor holdings.

Footnotes

1 Bloomberg, September 23, 2021,“Worsening Chip Woes to Cost Automakers $210 Billion in Sales.”

2 cnbc.com, July 29, 2021,“The global chip shortage is starting to hit the smartphone industry.”

3 Semiconductor Industry Association Report, December 3, 2019.

4 Ibid.

5 cnbc.com, September 18, 2020,“A brewing U.S.-China tech cold war rattles the semiconductor industry.”

6 Bloomberg, April 2021,“TSMC to Spend $100 Billion Over Three Years to Grow Capacity.”

7 EE Times Asia, September 2021,“TSMC Price Hike Indicates Capacity Tightness to Persist in 2022.”