Robeco launches biodiversity paper and teams up with WWF-NL

A Robeco positioning paper to address biodiversity loss is being backed by a partnership with the World Wide Fund for Nature Netherlands.

Summary

- Biodiversity paper details Robeco’s approach through investment and engagement

- New partnership begins with World Wide Fund for Nature Netherlands

- Issue is a material threat to investments and financial markets dependent on nature

The white paper is entitled ‘Robeco’s approach to biodiversity: Towards the integration of nature-related risks, opportunities and impacts in our investments’. It has been written by specialists from across Robeco’s engagement, climate and sustainable investing research teams and will form a blueprint for future policy in this arena.

However, the challenge is so complex that no single investor can do this on their own. Robeco is therefore proud to also announce the creation of a new partnership with the World Wide Fund for Nature Netherlands (WWF-NL) to complement existing collaborations such as the Finance for Biodiversity Pledge.

Both organizations are working together to integrate biodiversity into asset management. The partnership aims to develop a biodiversity investment framework and policy for Robeco and co-develop biodiversity investment strategies. It will also engage with clients and other stakeholders in the financial sector to create more awareness of the issue, and to inspire them to integrate biodiversity into their policies.

The daily destruction of forests, plants and animals due to human activity is seen as a challenge as great as the one the world faces with climate change. Investors can play a role in tackling issues such as deforestation and land use change through engagement and the integration of nature-related risks (and opportunities) into decision making.

“The financial sector and the asset management industry in which we sit has a crucial role to play in helping to prevent further biodiversity loss,” says Peter van der Werf, Senior Manager Engagement. “This is not something that is simply ‘nice to have’ in the context of sustainable investing: it is in the long-term interest of our clients and our investment performance, along with our duty to do our best to use our leverage to protect the planet.”

“Robeco has been addressing biodiversity issues for a number of years, through a dedicated engagement program on commodity-related deforestation, through our palm oil policy, and by assessing biodiversity as a material factor in our ESG integration process.”

“However, it is clear that there is much more that we need to do, both in terms of further engagement, and in embedding this factor systematically in our investment decisions. It’s no longer just a question of avoiding those companies that are responsible for biodiversity loss through their environmentally damaging operations. We must also embrace those companies that are striving to protect biodiversity, directing more capital towards these sort of sustainable enterprises.”

Outlining the urgency

The white paper outlines the urgency that biodiversity presents to the planet and the future stability of business life. The World Economic Forum estimates that more than half of the world’s economic output of USD 44 trillion is moderately or highly dependent on nature in some form, meaning that if natural systems collapse, so will our economic and financial systems.

The paper details the financial materiality this presents for investors: a heatmap assessment using data from the ENCORE tool (Exploring Natural Capital Opportunities, Risks and Exposure) developed by the United Nations Environment Programme Finance Initiative showed that around one-quarter of Robeco’s assets under management are highly dependent on at least one ecosystem service.

In line with the exposure of other financial industry participants, the assessment found that around 29% of Robeco’s investments are in sectors that have potentially high impacts on key drivers of biodiversity loss, led by use of land and freshwater, followed by climate change, pollution and direct disturbances. This shows that biodiversity is a highly material topic for investors and that action is needed across the financial industry to ensure that investments contribute to achieving the targets of the Convention on Biological Diversity.

Breaching planetary boundaries

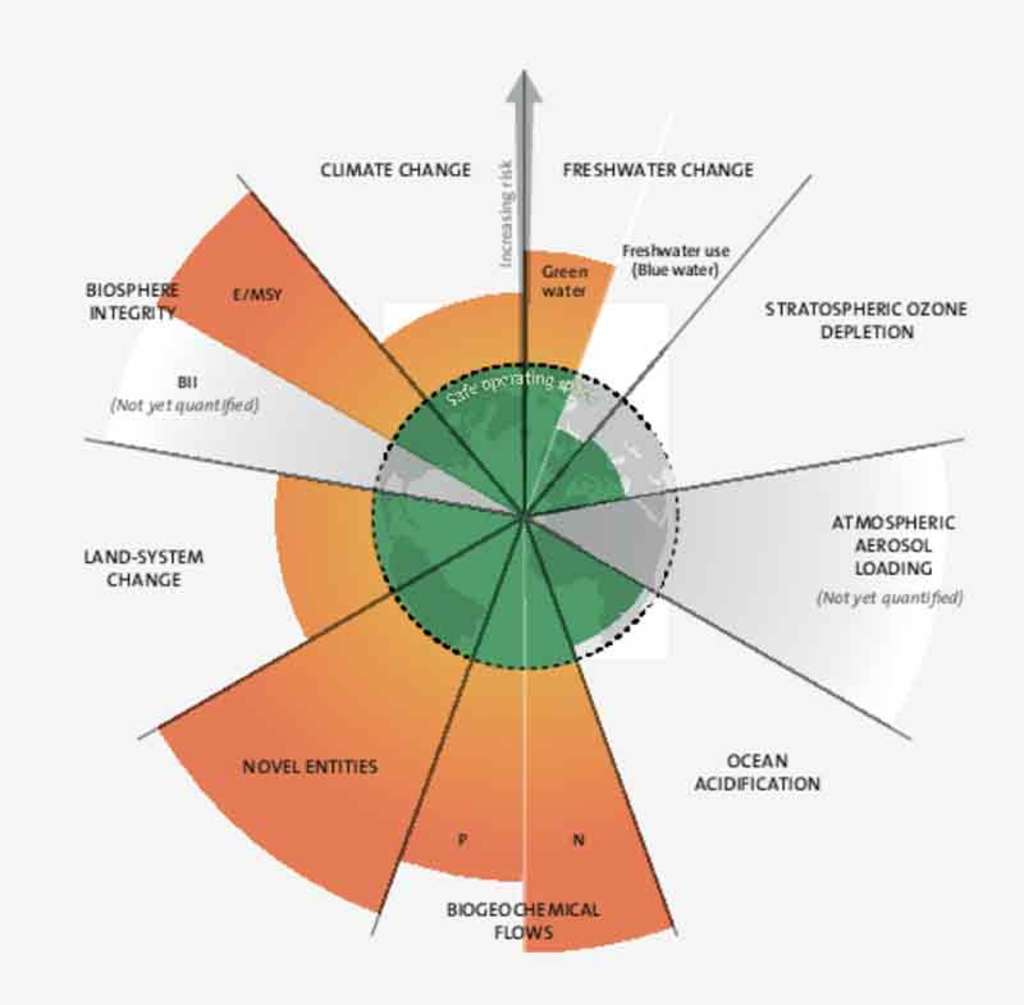

In 2009, Johan Rockström of the Stockholm Resilience Centre led a group of internationally renowned scientists to identify the nine processes that regulate the stability and resilience of the Earth system. The scientists proposed quantitative planetary boundaries within which humanity can continue to develop and thrive for generations to come.

Crossing these boundaries increases the risk of generating large-scale abrupt or irreversible environmental changes. The body of academic evidence continues to show that as unsustainable human development continues unabated, and as the climate change threat grows, two of nine planetary boundaries – the integrity of the biosphere and biogeochemical flows – have already been breached.

The breaching of boundaries threatens all life on Earth

Source: ‘Planetary boundaries: Guiding human development on a changing planet’.

A natural world in crisis

“The natural world is in crisis: never in human history has biodiversity declined as fast as it is doing so today,” says Aaron Vermeulen, Director Green Finance, WWF-NL. “Human pressures on nature are putting a staggering one million species at risk of extinction, many within only a few decades. Changes in land and water use, the direct exploitation of organisms, pollution and the introduction of invasive species threaten many ecosystems.”

“However, the nature crisis is not a standalone issue. Climate change is further exacerbating the drivers of nature loss, which in turn reduces our ability to sequester carbon and thereby mitigate climate change. This negative feedback loop also reduces our ability to withstand the impacts of climate change, since degraded ecosystems do not protect us as well against natural events as healthy ecosystems.”

“Robeco’s internal biodiversity roadmap, captured in this white paper, is a real step forward. It aims to understand and address nature-related impacts and dependencies across its organization. We look forward to collaborating with Robeco to ensure robust implementation.”

Greater collaboration

Such collaboration is fundamental to being able to create the data and tools needed to progress. Robeco is among the first signatories of the Task Force for Nature-Related Disclosure (TNFD), founded by the WWF and others. It aims to build a framework which will allow financial institutions to incorporate nature-related risks and opportunities into strategic planning, risk management and asset allocation decisions.

Robeco signed the Finance for Biodiversity Pledge in 2020, committing to protect and restore biodiversity through finance activities and investments by 2024.

“Our general aim is that within the next few years we will be able to measure and steer on our contribution as an investor to the protection of biodiversity and nature in partnership with WWF-NL and other collaborations such as the Finance for Biodiversity Pledge,” says Van der Werf.

“In this positioning paper we describe our journey – why we started it, what we have been doing, and where we aim to be. We hope you will enjoy reading it, and then join us on this vital mission.”

Download the publication

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.