Social sustainability – the S in ESG – relates to the rights, well-being and interests of people and communities. These issues include human rights, labor standards in the supply chain, child and forced labor, workplace health and safety, and relations with local communities. As such, social sustainability aims to improve the quality of human life at all levels.

In the workplace, this amounts to promoting equal opportunities for men and women, maintaining fair levels of pay, embracing diversity, and placing close attention to the impact of the company’s operations on its local population. A company that manages social issues well and takes the interests of its various local stakeholders into account, will obtain a ‘social license to operate’, meaning it wins acceptance or approval by local communities and stakeholders. This will facilitate the obtaining of government permits and ‘social permission’ to conduct its business. A company that does not address social issues risks reputational damage, increased costs and lawsuits.

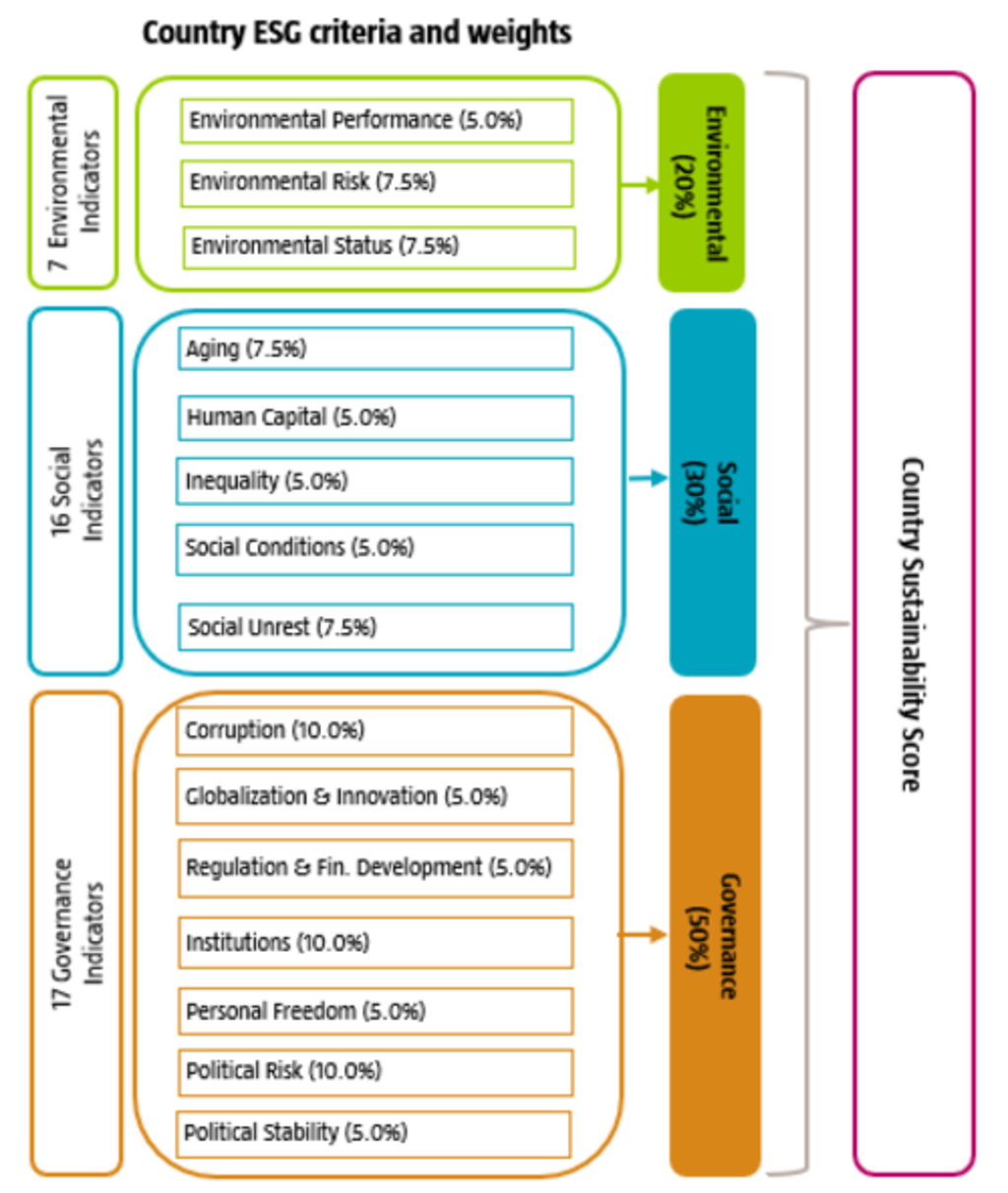

In the wider world, social sustainability refers to the upkeep of human rights and the stability of a society within its governmental system. Research by the Country ESG Ranking (CER) shows that democracies have a much higher level of social sustainability than countries with autocratic rulers, and western nations also generally rank higher than emerging markets.

Creating returns that benefit the world we live in

Source: Robeco

The CER gives a 30% weighting to social issues. Of this weighting, one quarter (7.5%) focuses on the issue of ageing and its attendant problem of the ability to pay pensions, and another quarter on the capacity for social unrest. While countries such as Saudi Arabia habitually score poorly for social issues, large democracies can also face unrest, as seen when the US scored lower in 2020 due to riots over police killings of black people.

The concept of reducing inequality is also considerd to be one of three megatrends shaping the world, along with climate change and cybersecurity. These were discussed in Robeco’s 2018 Big Book of Sustainable Investing, which attempted to quantify the economic impact of rising inequality. A 2017 IMF paper found that the inequality above a certain level starts to have a negative impact on economic development, reducing GDP by up to 0.35 percentage points a year. Poor social cohesion has also been blamed for rising right-wing populism as those who feel they have been marginalized seek redress.