Establishing that a credit is undervalued (or ‘cheap’) is an important step, but it is not enough. The real challenge – and opportunity – lies in conducting thorough fundamental research to ensure that the credit is indeed a value opportunity and not cheap due to underlying issues that could pose significant risks. So, where do we currently see value in global credit markets?

As an active credit manager, we focus on the relative value of issuers compared to a benchmark. This is best captured by comparing the credit spread of an issuer or specific sector to the index spread. For example, we can compare the credit spread on a BBB-rated corporate bond versus the average spread on a comparable BBB index. If the corporate bond trades at a higher credit spread compared to the index and relative to its own history, then this signals potential attractive value in the bond.

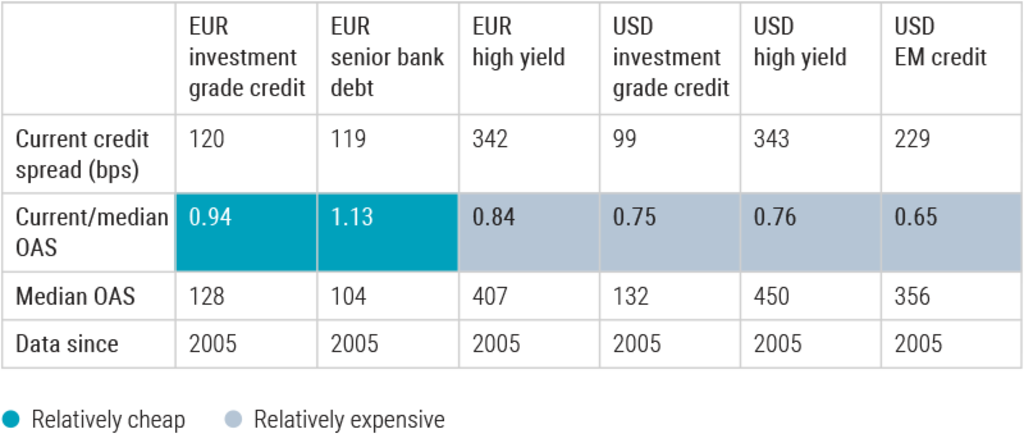

Our simplified valuation table below shows the option-adjusted spread (OAS) for various segments of the market, indicating which global credit market segments are undervalued and those that are overvalued.1 This is a measure used in credit analysis to compare the yield of a bond with the risk-free rate of return.

To identify whether a category is cheap or not, we compare the current spread (as of 14 August 2024) with its long-term median – in this case we go back to 2005. We prefer median over average spreads, as this dampens the impact of spread peaks caused by sudden spikes in volatility and/or gaps in liquidity.

The comparison, expressed as a ratio, clearly shows if a category is cheap (ratio above 1) or expensive (ratio below 1). For instance, if we look at USD investment grade credit, currently trading at a spread ratio of 0.75, this ratio illustrates that the market is roughly 25% more expensive versus its long-term history.

Source: Robeco, Bloomberg. Credit spread is defined as the option-adjusted spread over similar duration government bonds. Credit spreads shown here are based on the index spread for the relevant market. Credit valuation table as of 14 August 2024.

The spread ratio for EUR senior bank debt is currently 1.13, indicating that the average credit spread in this part of the global credit market is trading 13% above the long-term median spread level. We currently consider this part of the market attractive, therefore we have an overweight in EUR senior bank debt in our credit. Additionally, from a fundamental credit perspective, we favor European banks. The broader EUR investment grade credit market, with a ratio of 0.94, trades slightly below the long-term median spread level. This market includes financials and corporates. Notably, financials, as we have seen with EUR senior bank debt, trade at more attractive levels, whereas EUR corporates are at less appealing spread levels. Consequently, we are overweight financials and underweight corporates in the EUR investment grade credit market.

In conclusion, the approach above combined with top-down assessment of macro and corporate fundamentals as well as technical factors, is used to understand the segments, regions and sectors in the credit market that are currently attractive, and too expensive. While credit markets can appear to be expensive, strong demand for credit, lack of issuance, or accommodative central bank policy can keep these markets expensive for a prolonged period. This highlights the complex nature of credit investing and illustrates the importance of active management when identifying the winners in the credit market.

Footnote

1Please note that this table is not exhaustive, as we typically assess many segments and sectors of the global credit market.

See all articles in this series

Credit Investing opportunity

Seizing the opportunity in the credit market