Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

With the summer break underway in Europe, the four major central banks appear to be in wait-and-see mode.

Indeed, the Fed, ECB, and BoJ are all expected to hold rates steady this month, while the PBoC, having recently acted, also signals no immediate changes. However, we don’t believe this pause will last.

We suspect the Fed will soon be in double trouble, i.e. faced with ongoing political pressure as well as tension in their dual mandate: rising inflation pressures from tariffs and a weakening labor market. We expect the latter to prompt rate cuts – potentially as early as September. However, the risk is for a delay, especially if the Trump administration does not take a break from pressuring the Fed – and inflation risk premia rise further. Given too-low term premia in long-dated Treasuries we maintain a preference for curve steepeners.

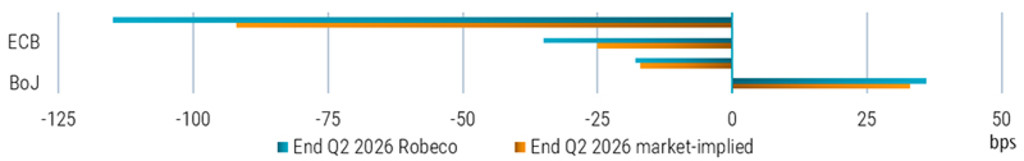

The ECB is well positioned, but looks likely to deliver some further easing later this year, given the prospect of at-target inflation, ongoing trade tensions and the sharp appreciation of the euro. Nonetheless, with the lower end of the neutral range in sight, we see little potential for a strong rally in 2-year Schatz yields (currently: 1.85%) and would turn more constructive on 10-year Bunds around the 2.75% level, viewing them as a remaining safe haven.

In China, low inflation and economic soft spots suggest the PBoC’s easing cycle isn’t over. Still, with credit growth improving and the currency having weakened, the central bank is in no rush.

The Bank of Japan has taken a break from normalizing policy rates. But our base case still sees one 25 bps hike before the end of the year, followed by another one in 2H 2026. In probability weighted terms, our outlook is slightly more hawkish than market consensus, leaving us modestly underweight JGB duration.

Source: Bloomberg, Robeco, based on money market futures and forwards, 17 July 2025

Subscribe to our newsletter for investment updates and expert analysis.