European equity - it’s always darkest before the dawn

If fairy tales are to be believed, then European equities have long been one of the ugly sisters to the Cinderella that is US stocks. Underperforming their American counterparts for years, European stocks have not enjoyed the more positive economic momentum that has underpinned growth over the pond. But the European story may at last have a happy ending, says equity investor Mathias Büeler.

Summary

- A litany of woes has led European stocks to underperform the US for years

- Higher spending power and lower rates bode well for European consumers

- Europe has some great stock market champions at attractive valuations

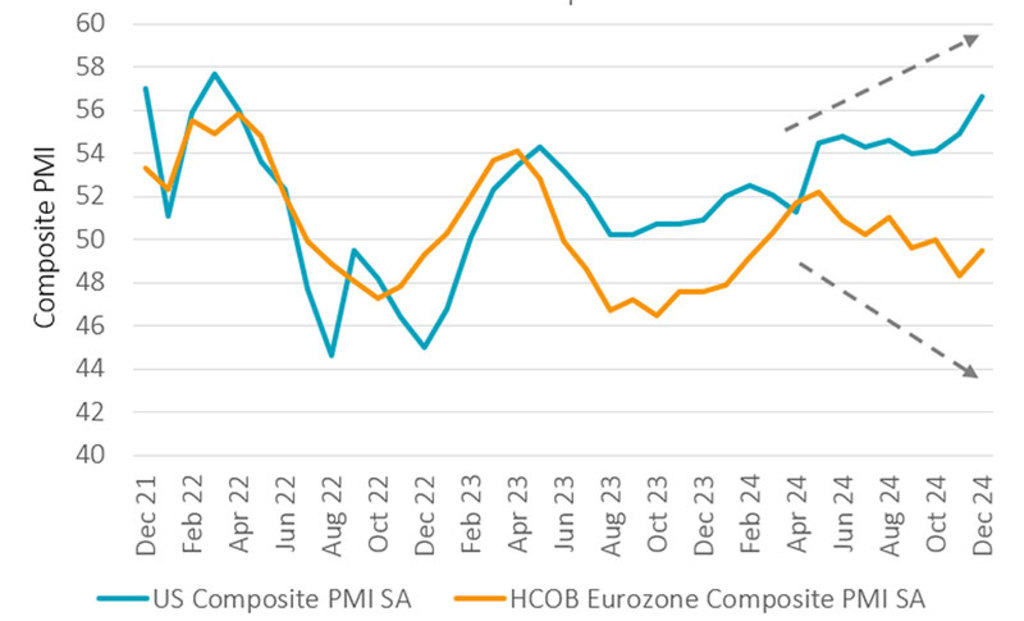

The diverging story can be seen in quite differing outlooks for the composite Purchasing Managers Index (PMI), a barometer of confidence in an economy where any reading above 50 signals growth. The European PMI has trailed its US counterpart since April 2023 and is currently at 49, indicating economic retraction, while the US PMI is at 57, signaling expansion. The story has been worse in the industrials sector, with the European automotive industry one of the most high-profile casualties.

However, there are several potential catalysts that could provide upside to European equities in 2025 and lead to a happy ending, says Büeler, Head of Sustainable European Equities at Robeco. These are led by reducing political turbulence, a ceasefire in Ukraine, a recovery in China, supportive monetary policy from the ECB, and rising consumer spending.

US & Eurozone Composite PMI

Source: Refinitiv

“The list of woes for European economies is long and new items are seemingly added every day,” he says. “This is reflected in the quite sobering current economic growth picture for Europe, particularly if we compare it to the US.”

“Muted economic growth in Europe coupled with downward earnings revisions has not stood up well in the momentum-driven market of the past two years. This has translated into some downtrodden European equity valuations.”

“While some of the rising discount may be rooted in sector mix and diverging structural earnings trends, let’s not also forget that Europe has some great global champions with highly attractive industries.”

“For instance, companies like ASML, L'Oréal, LVMH, Roche, Novo Nordisk and Nestlé that are showing no sign of exuberant valuation – quite in contrast to US quality stocks. Also, European companies' earnings power is not at all dependent on Europe, in the first place given their highly global revenue base.” 1

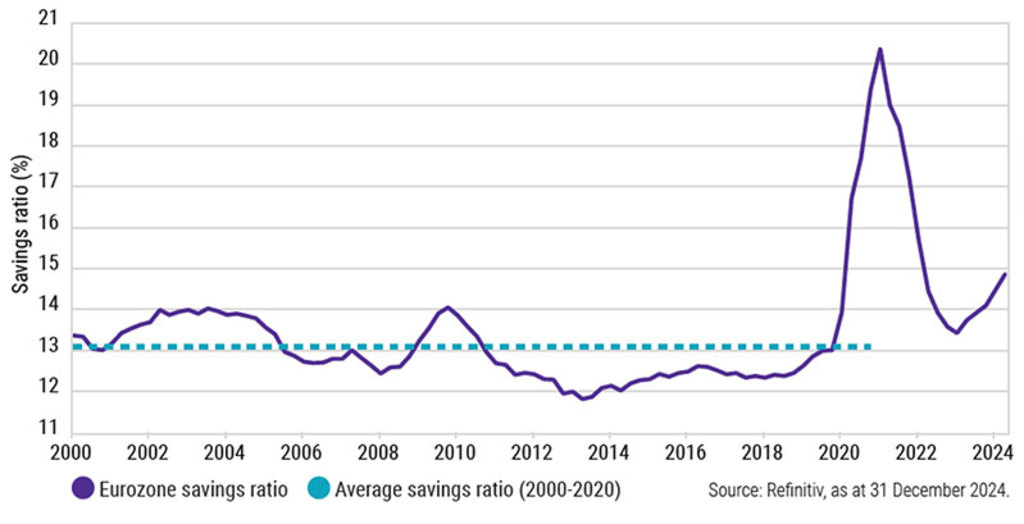

European consumers can spend

Much of the key to returning to growth lies in the spending power of consumers who ultimately dictate the success of any economy, along with the equities of the companies supplying the renewed demand. In the US, consumer spending following the pandemic has recovered to previous levels, but it has yet to catch up in Europe, where savings levels are much higher.

EU consumers can spend more 2025 - with less need to save

“Consumer spending by Americans has been a key driver of US growth and is why the US economy has grown faster than Europe,” Büeler says. “US employment remains strong and inflation has fallen, but cautious European consumers have been more focused on rebuilding their financial net worth, rather than spending. The household savings rate is well above the long-term average as a result of uncertainties, particularly the war in Ukraine.”

“Going forward, less negative sentiment bodes well for a recovery in consumption. Falling savings rates offered by banks may also trigger a less frugal mindset for European consumers.”

Stronger loan demand

For those who still need loans, credit standards for businesses in Europe have been easing since mid-2023, fueling a rebound in demand from low levels. “In combination with lower interest rates and increasingly accommodating monetary policy, this could spur a pick-up in investments, in particular in construction, which is rate-sensitive,” Büeler says.

“There are also signs that demand for household credit in the Eurozone is on the rise, as in November it increased at the fastest pace in 18 months. In particular, housing loan demand rebounded strongly on the back of expected interest rate cuts and improving housing market prospects.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

US and Europe diverge on monetary policy

The rate differential that is making savings less attractive and borrowing money cheaper in Europe is getting wider, due to differing central bank policies on either side of the Atlantic.

The European Central Bank (ECB) cut rates four times in 2024 and has kept the door open for further easing this year. This will reduce the interest rate costs for European corporates, especially the small and mid-cap stocks that rely more on bank financing than on issuing corporate bonds.

“Lower relative interest rates will likely be positive for most European companies, particularly mid-cap companies that tend to have more floating rate debt,” Büeler says. “We will need to wait and see if lower debt servicing costs translate into a material uptick in European company earnings in 2025, but we are moving to the modestly optimistic camp.”

“While the European stock market is light on AI hype, there are some sectors that have a global competitive advantage: civilian aerospace leadership, premium luxury goods, resource transition, and intellectual property in pharmaceuticals.”

Footnote

1The companies shown are for illustrative purposes. The companies are not necessarily held by a strategy. This is not a buy, sell or hold recommendation, or investment advice. Future inclusion of these securities in portfolios s not guaranteed, nor can their future performance be predicted.