How Value investors can avoid the climate traps

Successful value investing and the decarbonization of portfolios are typically considered difficult to reconcile. This is especially the case after the recent comeback made by stocks from the energy sector, which often fall in the value camp. But we show it would have been possible to achieve both strong exposure to the value factor and a substantially lower carbon footprint than conventional value strategies.

Summary

- Conventional Value investing exposes investors to climate traps

- Value strategies can be ‘decarbonized’ effectively

- Decarbonized Value remains attractively valued

Investors often face a dilemma when trying to both decarbonize their portfolio and get exposure to the value factor. The reason is that conventional value strategies tend to have high environmental footprints, including greenhouse gas (GHG) emissions, and are therefore typically exposed to what we call ‘climate traps’.

Such stocks may look cheap using common valuation metrics, but this is mainly because their environmental footprints are not well reflected in accounting numbers. Also, with the rise of sustainable investing, high-footprint stocks are expected to show structurally lower valuations. These stocks will turn increasingly attractive based on simple value metrics, implying that such metrics may no longer be adequate.

Effective value investing requires adjusting valuation models for future carbon costs

Effective value investing therefore requires adjusting valuation models for these future carbon costs. Considering this, we designed an innovative methodology to derive a ‘decarbonized value’ signal in 2019.1 This methodology adjusts the valuations of high-polluting firms, making them less attractive based on their environmental footprints and works, economically speaking, similarly to a pollution tax. 2

Our research shows that this approach would have effectively reduced the carbon footprint of value strategies over the 1986-2023 period, without giving up exposure to the value factor. Indeed, simulations suggest that the adjustments made do not cause major changes in terms of value exposure at portfolio level. As a result, decarbonized value can have a value exposure comparable to the conventional one.

In fact, we see that while some performance differences did appear over shorter periods of time, the correlation between the two value strategies generally remained very high over the past three and a half decades, and both performances tracked each other closely over the long run. Importantly, decarbonized and conventional value exposures offered comparable historical returns.

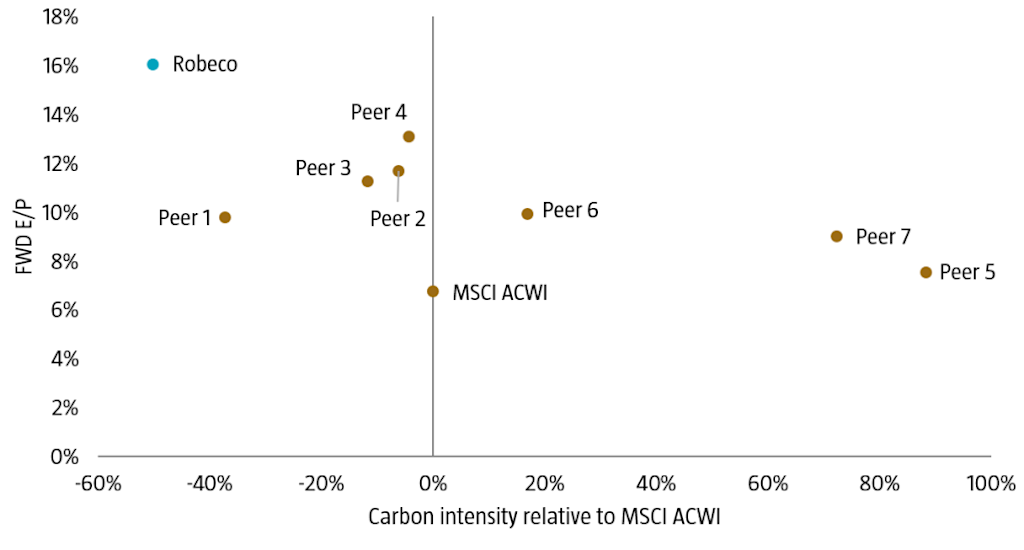

Moreover, we find that this holds true not just for simulated portfolios, but also in practice for real portfolios. Figure 1 plots these two measures for a set of value managers, including our Robeco QI Global Value Equities strategy, that implements our decarbonized value approach. The x-axis shows the relative carbon intensity, while the y-axis shows the forward price-to-earnings ratio.

Figure 1: Value exposure versus carbon footprint of set of Value

Source: Robeco, Morningstar, Refinitiv, I/B/E/S. The chart shows the forward earnings-to-price ratio (FWD E/P) and the carbon intensity relative to MSCI ACWI Index for a sample of global fundamental and quantitative value managers from Morningstar as of December 2022.

As the chart illustrates, most value managers have a larger or similar carbon footprint compared to the index, while two value managers – including Robeco – have a footprint below the index. At the same time, the value metrics of the portfolio remain high on our portfolio, showing that high value exposure is combined with a low carbon footprint, and low exposure to climate traps.

Value remains very attractive from a valuation perspective

Finally, we find that despite the significant market rotation seen since November 2020 and the related value comeback, both conventional and decarbonized value approaches continue to trade at attractive valuation spreads. More specifically, for both strategies, the valuation spread between value and growth stocks is much wider at the end of March 2023 than at the beginning of the value winter in 2018.

Conventional and decarbonized value approaches continue to trade at attractive valuation spreads

In fact, current spreads are still at levels close to those seen at the peak of the dot-com bubble in 2000, meaning that both conventional and decarbonized value continue to trade at very attractive valuation levels, from a historical perspective. Despite the strong rebound of value stocks over the past couple of years, conventional and decarbonized value approaches still have significant upside potential.

Footnotes

1 Swinkels, L., Ūsaitė K., Zhou, W., and Zwanenburg, M., October 2019, “Decarbonizing the Value factor”, Robeco article.

2 Cf., Blitz, D., and Hoogteijling, T., April 2022, “Carbon-Tax-Adjusted Value”, Journal of Portfolio Management.

Discover the value of quant

Subscribe for cutting-edge quant strategies and insights.