Impact investing aims to create a measurable beneficial impact on the environment or society while earning a positive financial return. It has three key components that collectively distinguish it from mainstream investing:

Intentionality: an investor deliberately sets out to exert a positive impact

Measurability: the benefits should be measurable and transparent

Returns: it should make a financial return; this is not charity or philanthropy

In addition, impact investments need to have additionality, meaning that the positive societal outcome can be attributed to the investor. As a result, many argue that public markets are not suitable for impact investing, for two reasons.

Firstly, public markets mainly deal in secondary trading on exchanges such as the stock or bond market. Because the company is not a counterparty in the transaction between the buyer and seller, the investment has no direct effect on its balance sheet, and, in turn, its ability to scale its positive impact.

Secondly, public markets mainly concern investments in large, established companies that do not need the extra capital that impactful projects require. Such investments are thus said to be lacking additionality, even if they have the intentionality, are measurable, and make a return.

Impact-aligned versus impact-generating

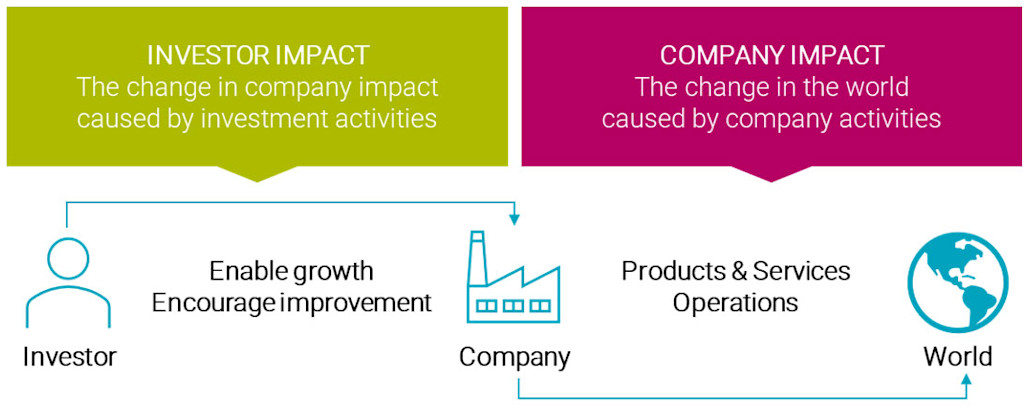

For these reasons, a more neutral phrase, ‘impact-aligned investing’, was often used, as this conveys the intentionality while making clear that it is aligned with a motive, rather than making an absolute statement. The impact is made by the company itself, rather than by the investor.

But there is also the possibility of ‘impact-generating investments’. These strategies drive changes in the impact of companies, often through shareholder engagement. Here, the investor can show that it made a difference. In short:

Impact-aligned investments focus on allocating capital to companies that already create positive impacts.

Impact-generating investments is where the impact is attributable to the investor buying the shares or bonds of companies.

SDG Framework

Robeco uses its proprietary SDG Framework to measure companies’ impact on one or more of the 17 Sustainable Development Goals by assessing its products and services, along with its operational impact, while also screening for controversies. Companies are then scored on a range from -3 (highly negative) through 0 (neutral) to +3 (highly positive).

Companies’ contributions to the SDGs form the basis of Robeco’s impact-aligned investments, while engagement lies at the heart of impact-generating strategies. Robeco has used active ownership since 2005 to persuade companies to become more sustainable, and now has three bespoke strategies relying on engagement as the primary tool for advancement. These focus on improving contributions to the SDGs, halting biodiversity loss, and making the fashion industry more sustainable.

Robeco’s approach

For a full explanation of Robeco’s approach to impact investing in public markets, see our white paper here.