The EU Taxonomy is a strategy to create a harmonized understanding of what actually constitutes sustainable activities across the European Union. It attempts to define ‘green activities’ for the first time, using minimum criteria that economic activities should comply with in order to be considered environmentally sustainable.

As such, it forms a key component of the EU’s Sustainable Finance Action Plan, which aims to promote sustainable investment across the 27-nation bloc, and the EU’s Sustainable Finance Disclosure Regulation (SFDR), which aims to make the sustainability profile of strategies more comparable and better understood by end-investors.

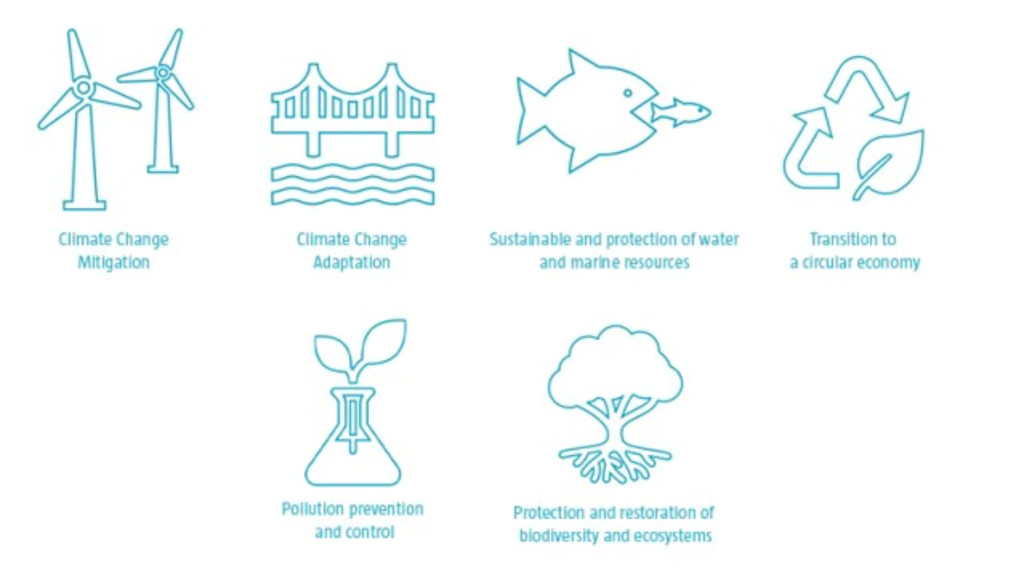

The Taxonomy states that only activities which substantially contribute to one or more of six environmental objectives should be defined as being green. These are climate change mitigation; climate change adaption; protecting marine and water resources; transitioning to a circular economy; preventing pollution; and protecting and restoring biodiversity and ecosystems.

Disclosing alignment

Large listed companies incorporated in the EU are required to report which part of their revenue and expenditure is in line with the Taxonomy. These corporate disclosures are being introduced in two phases. In 2022, companies began disclosing the percentage of revenues and expenditure in economic activities that are listed in the Taxonomy (i.e. eligible activities) as contributing to the climate change mitigation and climate change adaptation objectives.

From 2023 onwards, companies must also assess whether these eligible activities also comply with the Taxonomy’s technical screening criteria (i.e. aligned activities) covering all six environmental objectives.

The technical screening criteria set a high bar on the environmental performance that activities must meet in order to evidence their substantial contribution to an environmental objective, and demonstrate that they do not significantly harm any other objective. As a result, there is the possibility that the percentages of Taxonomy-aligned figures that will be reported in 2023 are lower than the Taxonomy-eligible figures disclosed in 2022.

SFDR regulation

SFDR is an evolving set of EU rules aiming to create a level playing field for how sustainable investment strategies are classified by asset managers. It helps to clarify the definition of a ‘sustainable fund’ and combat the growing threat of greenwashing.

Changes under SFDR Level II

Under the SFDR, asset managers are required to disclose the percentage of their assets under management that sit within Taxonomy-aligned activities. Only strategies classified as Article 8 or 9 are in scope for disclosures, i.e. those strategies that promote their environmental characteristics, or those pursuing a distinct sustainability objective.

This reporting requirement entered into force in January 2022 under SFDR Level I legislation. From January 2023 onwards, financial products will disclose more granular information under SFDR Level II standards.

More glossary terms