The Sustainable Finance Disclosure Regulation (SFDR) is an evolving set of EU rules that aims to create a level playing field for how sustainable investment strategies are classified by asset managers. As its use becomes more widespread, enhancements are added every few years. Sustainable investors welcome the SFDR as an opportunity to clarify the definition of a ‘sustainable fund’ and combat the growing threat of greenwashing.

Our Glossary of Sustainable Investing explains the main ingredients:

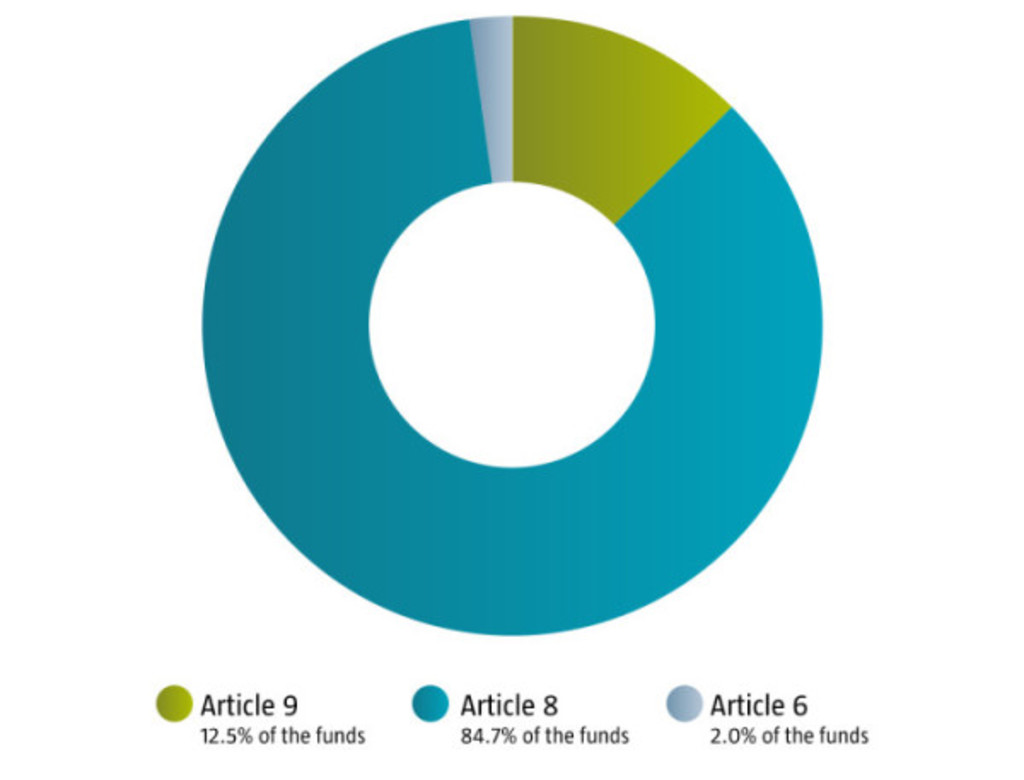

SFDR classification reflects the sustainability of Robeco’s fund range

The SFDR regulation forces asset managers to disclose the level of sustainability integration for their different strategies. These are now classified as Article 6, 8 or 9.

Article 6 funds do not promote environmental social or governance (ESG) factors.

Article 8 funds include environmental or social characteristics in the investment process.

Article 9 funds pursue a specific sustainability objective such as climate benchmarks.

Almost all of Robeco’s funds are aligned to Article 8 or 9 of the EU’s new sustainability regulations.

Robeco funds: 98% Article 8 or 9

Source: Robeco, May 2024

SFDR and transition investing

The SFDR is part of the wider Sustainable Finance Action Plan and European Green Deal, which are specifically aligned with the Paris Agreement. This seeks to limit global warming to maximum 2 °C above pre-industrial levels by 2100, and more ideally to limit it to 1.5 °C.

The 1.5 °C target requires the world to achieve net zero emissions by 2050. However, we are currently way off track from meeting it. The latest climate research shows that the world has already warmed by 1.2 °C – and possibly even more – with carbon emissions still rising. If left unchecked, the world will warm by around 2.4 °C by the end of this century, a level that could cause catastrophic and irreversible climate change.

Subsequently, the race is on to find ways to cut reliance on fossil fuels, move to renewable sources of energy, electrify key areas such as transport, and find more sustainable forms of construction. It requires a transition to a low-carbon economy that is unprecedented in human history, requiring trillions in investment capital for the solutions to the global problem.

Robeco has therefore developed a whole repertoire of potential investment solutions, from bespoke transition investments and funds looking at Smart Energy, to Paris-aligned benchmarks, strategies targeting the Sustainable Development Goals (SDGs), and targeted decarbonization products. All are backed by decades of experience in integrating ESG into the investment process, with a heightened focus on the environmental aspect, as climate change is tackled head-on.

SFDR: It does what it says on the tin

Rather than viewing the SFDR as more red tape regulation, most investors have embraced it as achieving three main goals. First, it creates an agreed framework for a sustainable investment, with clear definitions behind the three articles. Investors within the EU can no longer interpret legislation at will, as many such interpretations have been conflicting or prone to greenwashing in the past, where the true contribution to net zero is overstated.

Second, the articles make clear what levels of sustainability the investments contain, providing the investing public with greater confidence and clarity. The Robeco Global Climate Survey 2024 highlighted greenwashing as one of the biggest fears that investors have when it comes to sustainable investing.

In total, the articles have provided a backdrop for what a UK advertising campaign once described as ‘It does what it says on the tin’. An Article 8 fund does attempt to contain some element of sustainability, whereas an Article 6 fund does not try to.

Is SFDR Article 9 better? Not necessarily…

The third benefit is more surprising as it has led to a greater focus on the level of transition that is encompassed by the Articles. When they first came out in 2021, many perceived Article 9 as logically being better than Article 8, since it only allowed companies that were provably sustainable into the investment fund. Since then, the focus has moved on to transition, rather than fixating on companies that are already ‘oven ready’.

This has ironically led to more investors preferring Article 8 funds, since the companies within are somewhere on their journey to become sustainable, particularly regarding achieving net zero. These can offer greater potential than Article 9 funds, for whom the transition has largely already been achieved. As another saying goes, ‘Often it is better to travel than to arrive’.

And since very few companies, along with the funds that hold them, are already 100% sustainable, it means there is a far greater choice for Article 8 funds than for Article 9. As shown above, this is reflected in Robeco’s own assets under management, for which 84.7% are Article 8 and 12.5% are Article 9. Article 6 funds are generally avoided, as they do not attempt to contain sustainability, and at Robeco are confined to cash or derivatives-based products.