Quant chart: Successfully reducing drawdowns

In investing, minimizing losses is crucial for long-term capital growth. This timeless truth is especially relevant today, with major stock market indices experiencing significant drawdowns. To illustrate this point, a 20% loss requires “only” a 25% gain to recover, while a 50% loss demands a staggering 100% rebound.

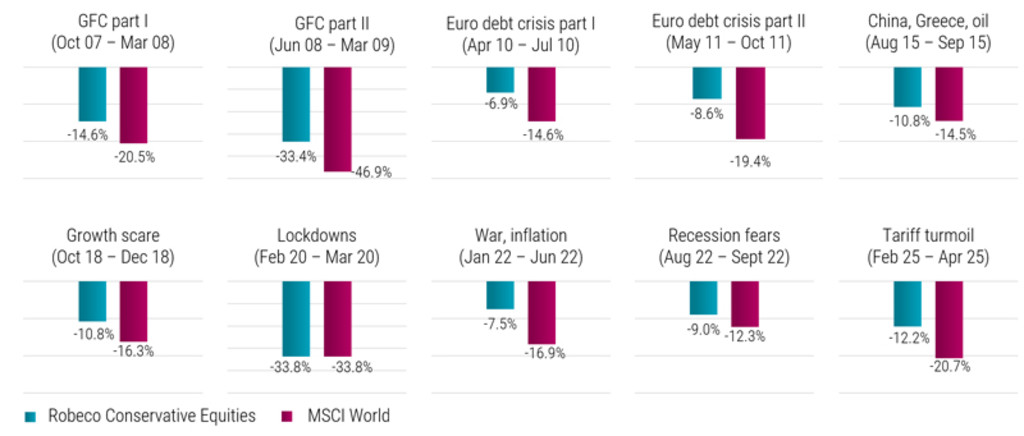

The Robeco Conservative Equities strategy is designed to win by losing less during market downturns. Over its nearly 20-year live track record, the global equity market has endured ten distinct episodes of drawdowns exceeding 10%, as illustrated in Figure 1.

Figure 1 | Real-life drawdown reduction during ten distinct market drawdowns

Past performance is no guarantee of future results. The value of your investment may fluctuate. Source: Robeco. The figure shows the maximum drawdowns of the Robeco Conservative Equities strategy versus the MSCI World Index during ten distinct market drawdown episodes since the start of the strategy in October 2006, as selected by Robeco. The length of the period is based on when MSCI World reached the pre-sell-off level (not yet reached again for the “tariff turmoil” scenario, for which the drawdowns are measured up to April 29, 2025). Drawdowns are measured based on daily data in EUR of the net asset value of the representative account Robeco QI Institutional Global Developed Conservative Equities strategy, gross-of-fees. In reality, costs such as management fees and other costs are charged. These have a negative effect on the returns shown.

Since then, the strategy has successfully navigated multiple periods of volatility, including the European debt crisis (2010/2011), the oil price shock (2015), and the growth scare of 2018, which, notably, was also linked to early tariff tensions under the Trump administration. These drawdown periods were followed by the first Covid-19 lockdown (2020), stagflation concerns (2022), and the ongoing tariff turmoil (2025). While the current episode is still evolving, recent uncertainty surrounding central bank independence has further unsettled investors.

Across all these ten market corrections — with the exception of the first pandemic lockdown — the Robeco Conservative Equities strategy delivered the expected downside protection. More specifically, while the MSCI World Index experienced an average drawdown of 21.6%, the Robeco strategy averaged just a 14.8% drawdown, reducing relative risk by more than 30%. The ability to limit loss highlights the strategy’s effectiveness in preserving capital and supporting long-term compounding.

Although the strategy may lag during strong bull markets, its consistent downside protection has contributed to better long-term results. From its inception in October 2006 through March 2025 (excluding April data), the strategy has delivered an annualized return of 8.3%, compared to 7.8% for the MSCI World Index, both in EUR. Importantly, it has done so with significantly lower volatility — offering equity investors a smoother, more reassuring ride.