Robeco Climate Survey: Biodiversity investing is becoming mainstream

Investors are taking a much stronger stance on biodiversity, pushing the once niche topic into the mainstream.

Summary

- 66% say biodiversity will be a key part of policy over next two years

- Global equities, green bonds and impact strategies are preferred vehicles

- Lack of data and internal expertise seen as greatest impediments

Often seen as the other side of the climate change coin, biodiversity is moving towards such parity when it comes to embedding the issue in investment policies and portfolio management, the 2023 Robeco Global Climate Survey reveals.

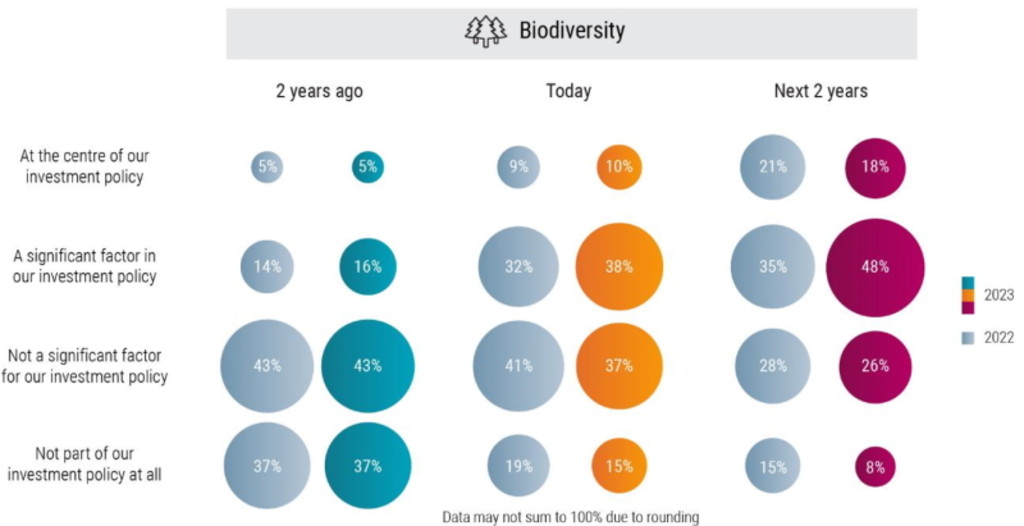

Some 66% of investors surveyed said biodiversity will be a significant or central factor in their investment policy over the next two years, while 48% said this is the case today. That’s a massive rise from the 16% for whom it was significant, and 5% for whom it was central, two years ago. Investors in Europe are leading the way on most metrics, the survey of 300 institutions showed.

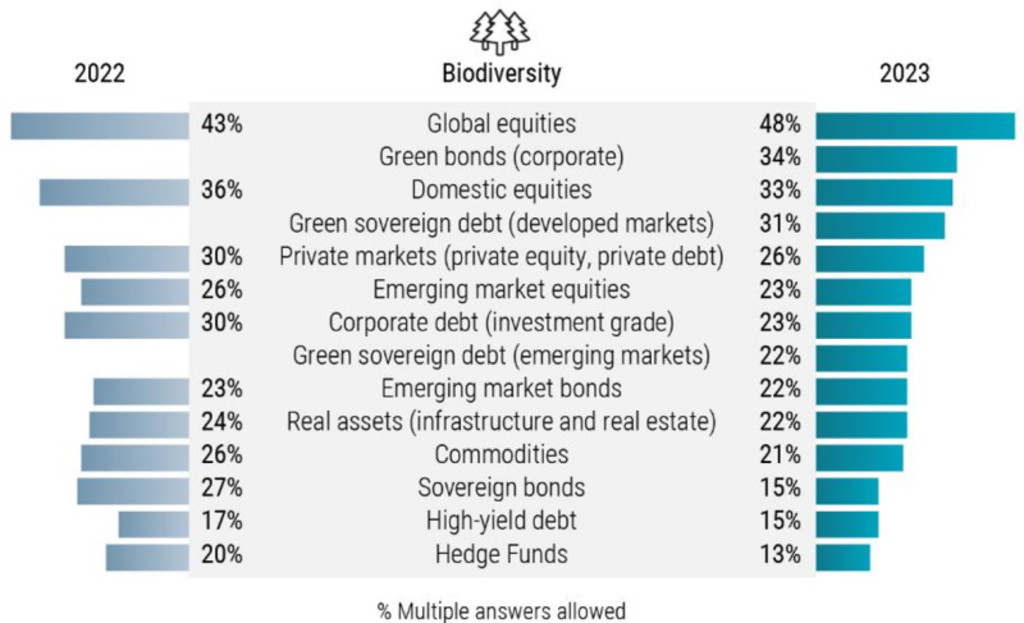

Global and domestic equities and corporate green bonds are the most favored asset classes for the integration of biodiversity issues over the next one to two years. Only 25% are currently using investment products specifically targeting biodiversity goals, but there has been a big jump in demand for impact investing and thematic strategies compared with the 2022 survey.

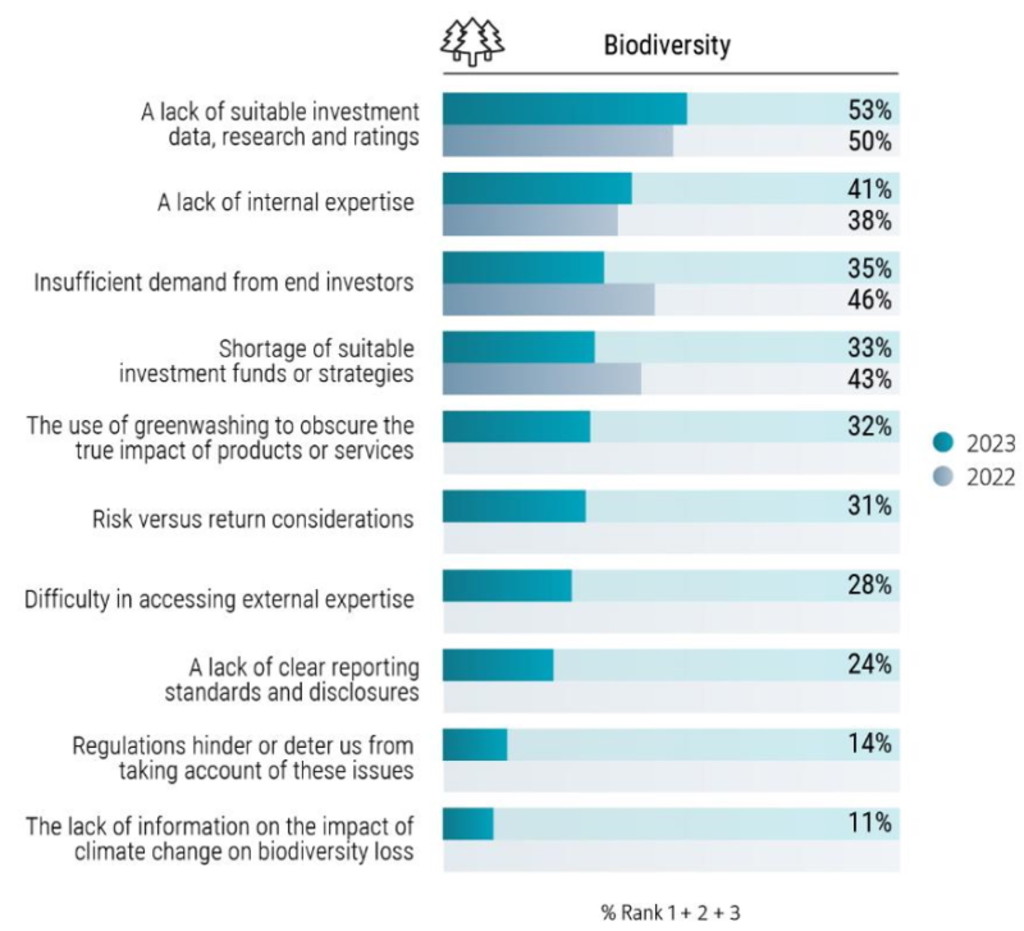

However, there remain significant barriers in moving from aspiration to implementation when it comes to biodiversity, the problems for which are often highly localized and difficult to tackle. More than half of investors blamed a lack of suitable data and ratings, followed by a lack of internal expertise, while one-third complained of a lack of biodiversity investment products.

“Investors are clearly struggling to define a practical approach for addressing biodiversity risks and opportunities in their investment processes,” says Lucian Peppelenbos, Climate and Biodiversity strategist at Robeco. “Data is cited as challenge number one.”

“The problem is actually not a lack of data. There are numerous datasets on the state of species and ecosystems. The real challenge is to connect that biodiversity data in meaningful ways to company data. How does the business model of a specific company depend on ecosystem services, and how does that company and its value chain contribute to ecosystem decline?”

“We know that this type of assessment will improve over time, as companies and investors adopt the disclosure framework of the Taskforce for Nature-related Financial Disclosures (TNFD). But at Montreal in December 2022, governments agreed to bend the curve of biodiversity loss by 2030. There are only seven years left, so frankly there is no time to wait for perfect data.”

How would you describe the importance of biodiversity to your organization's investment policy two years ago, today, and in the next two years?

Europe leads the way

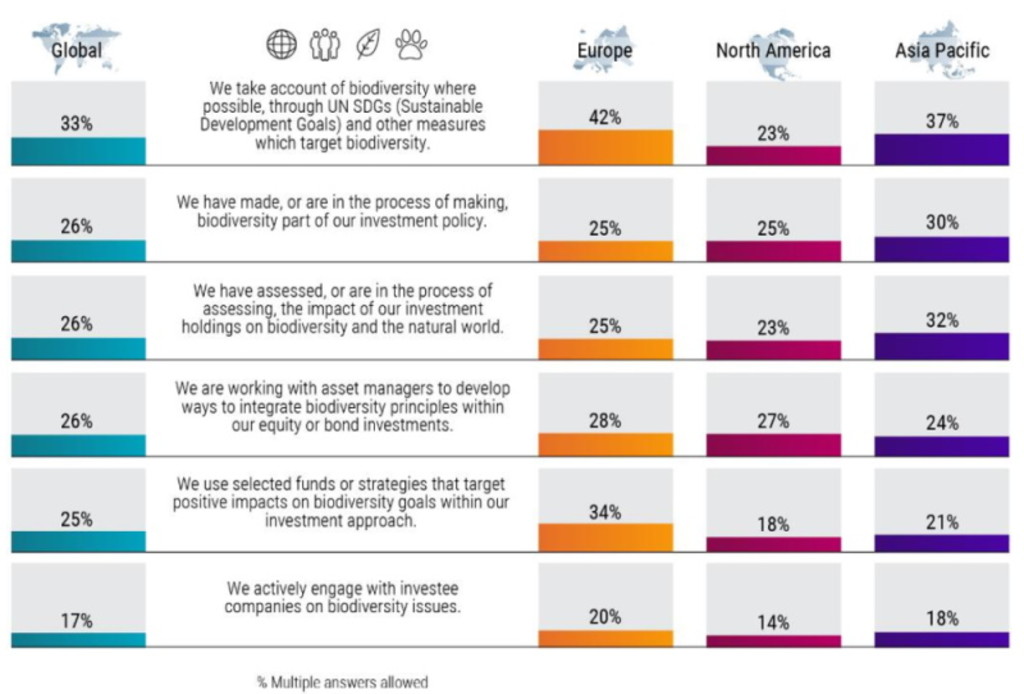

Regionally, the survey highlighted differences in interest and approaches across the world. Some 42% of European investors said they take biodiversity into account where possible, using vehicles such as the Sustainable Development Goals (SDGs) to accomplish their aims, compared with 37% of Asia-Pacific investors, 23% in North America, and a global average of 33%.

Europeans are also more likely to use targeted investment products, with 34% investing in selected biodiversity strategies compared with 18% in APAC and 14% in North America. The use of active ownership is also stronger in Europe, with 20% using engagement with investee companies compared with 18% for APAC and 14% for North America.

Institutional investors are slightly more likely to place biodiversity at the center of investment policies than wholesale investors. As with climate change, larger investors with more than USD 500 billion in assets are more likely to make it an important focus than smaller firms, who may lack the resources for greater involvement.

What steps has your organization taken so far to take account of biodiversity in its investment approach?

Equities preferred

Regarding asset classes, mainstream global equities (48% of investors) and corporate green bonds (34%) are the most common asset classes being used to integrate biodiversity into portfolios, followed by equities in domestic markets (33%) and green sovereign debt (31%).

Interest in the use of private capital markets fell slightly from 30% to 26%. APAC investors are more likely to use emerging market assets emanating from their own locales, while North American investors are more likely to do this in commodities, the survey showed.

“We believe that investors can already address key biodiversity impacts by focusing on the contribution of companies to the drivers of biodiversity loss, be it water pollution, plastic discharge, climate change, or deforestation,” Peppelenbos says.

“And then investors need to assess how well companies are mitigating that contribution – which means looking at response metrics rather than impact metrics. That focus helps simplify the picture and enables investors to already identify biodiversity leaders and laggards.”

Which asset classes, if any, will your organization prioritize for deeper integration of biodiversity issues over the next one to two years?

We need better data

For the headwinds preventing greater adoption of biodiversity in portfolios, the survey revealed a clear need for better data, research and ratings. The proportion of investors blaming a lack of data rose to 53% from 50%, while those citing a lack of internal expertise rose from 38% to 41%.

Some 24% complained of a lack of clear reporting standards and disclosures. The release of the TNFD’s final framework in September aims to remedy this, since it is set to become the biodiversity equivalent of the Taskforce for Climate-related Financial Disclosures (TCFD), which is already steering how investors handle the issue.

The launch of many bespoke biodiversity products in recent years has eased complaints about a lack of suitable strategies, with the number citing this as a headwind falling from 43% to 33%. The belief that there is insufficient demand from end-investors also dropped, from 46% to 35%. In 2022, Robeco launched a bespoke Biodiversity Equities product to try to tackle this gap in the market.

Those looking for more thematic strategies rose to 57% from 40%, while those looking for more biodiversity-positive variants of existing core equity and fixed income holdings rose to 56% from 30%. Much of the latter can be achieved through more rigorous biodiversity-related screening. European investors have a higher preference for excluding and divesting from the worst offenders on biodiversity (50%), while 35% supported this globally.

What are the biggest challenges for your organization when seeking to take account of decarbonization and biodiversity principles in its investment portfolio?

Wider climate change

The biodiversity findings are consistent with the principal question in the third annual survey: the number of investors for whom climate change is a significant part of, or central to, their investment policy. This has remained stable at 71%, slightly down from the 75% seen in 2022, following a barrage of headwinds. The figure is, though, projected to rise to 85% over the next two years.

However, sentiment was hurt by a number of headwinds, led by greater geopolitical uncertainty following Russia’s invasion of Ukraine. This added to inflationary pressures and triggered an energy price spike, particularly in Europe, leading some investors tone down their sustainability efforts in areas such as exiting fossil fuels in the short term.