Objectives

Return: maximize on Sharpe ratio – with sustainable themes while not underperforming market

Beta: targeting a beta of 1 against the benchmark

Fund limit: maximum exposure 19% to be UCITS compliant

Return: maximize on Sharpe ratio – with sustainable themes while not underperforming market

Beta: targeting a beta of 1 against the benchmark

Fund limit: maximum exposure 19% to be UCITS compliant

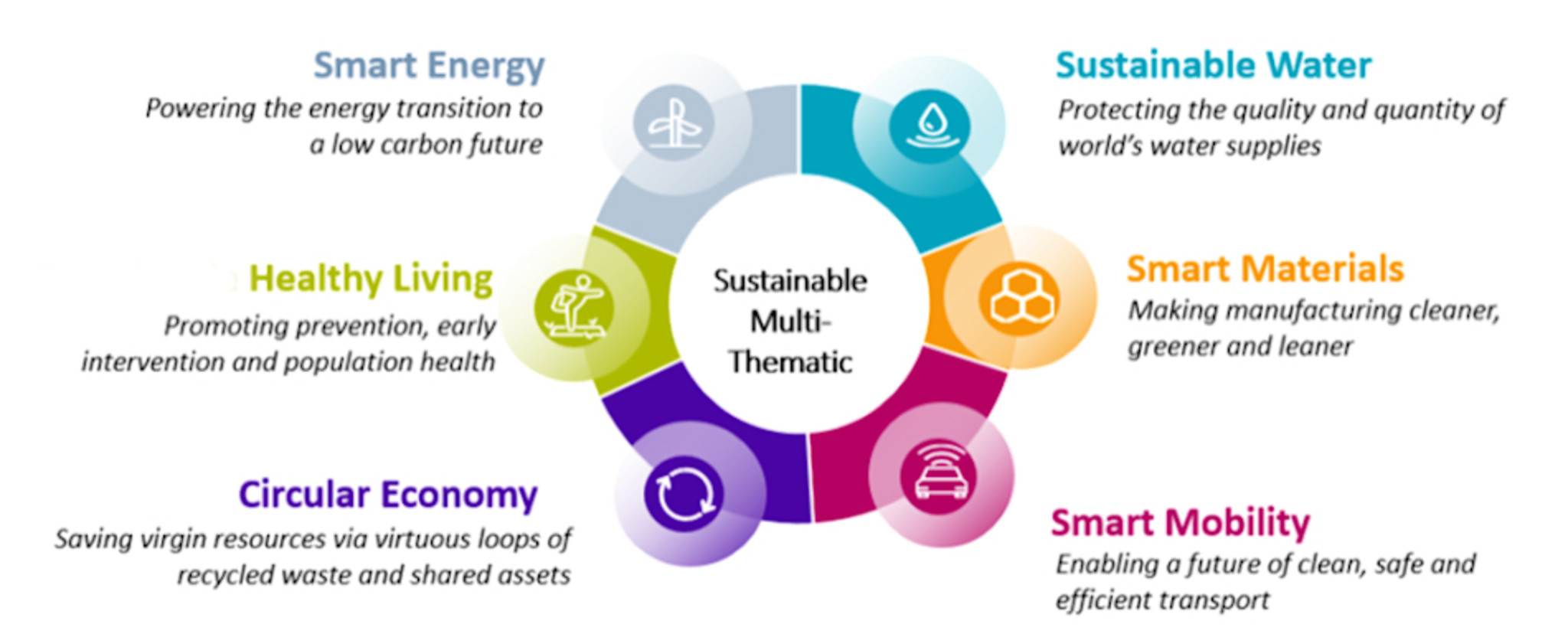

The solution was to combine six of Robeco's specialist sustainable strategies that achieved all these objectives. The multi-thematic offering included all three strategies in the renewable energy-related 'Smart' range – Smart Energy, Smart Mobility and Smart Materials – along with the Circular Economy, Sustainable Water and Healthy Living strategies.

The portfolio has outperformed the benchmark in terms of annualized returns and it also has a favorable risk-adjusted returns with a higher Sharpe ratio against benchmark.

Past performance is no guarantee of future results. The value of the investments may fluctuate. Annualized (for periods longer than one year).

If you have any questions, or would like to speak to us, please let us know.