Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Explore how Australian superannuation funds can integrate climate objectives into their passive equity allocations while adhering to the stringent YFYS regulation.

Integrating climate objectives into investment strategies is increasingly important for Australian superannuation funds. However, meeting the stringent requirements of the YFYS (Your Future, Your Super) performance test poses a significant challenge. Robeco provides solutions that allow funds to achieve their climate goals while adhering to regulatory constraints.

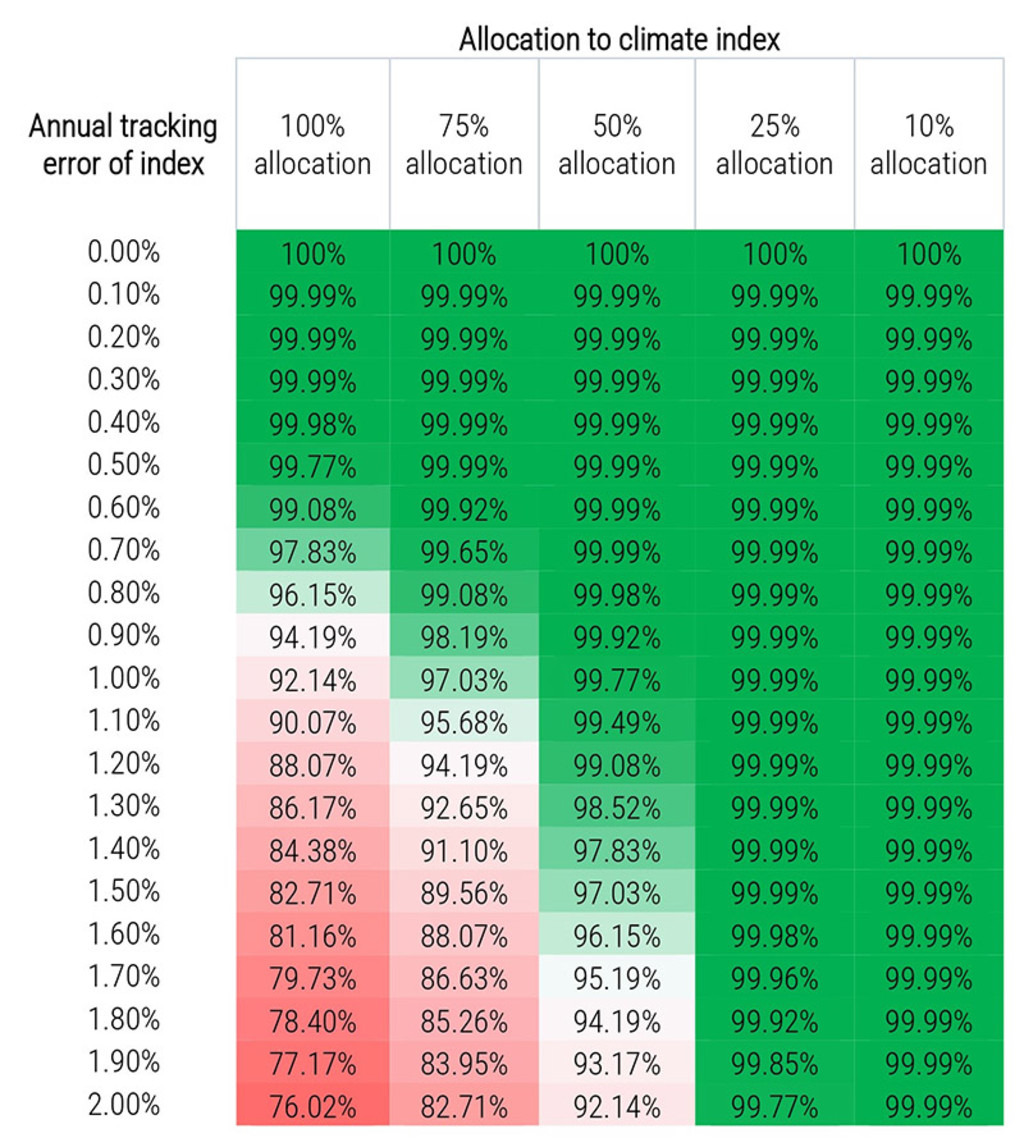

Under the YFYS performance test, superannuation funds must ensure their cumulative underperformance relative to the Strategic Asset Allocation (SAA) benchmark does not exceed 0.50% per year over a rolling 8-year period. To navigate this, funds can either fully allocate to a low tracking error climate index or partially allocate to such an index while maintaining a passive investment in the SAA benchmark. For instance, a 100% allocation to a climate index with a 50 bps annual tracking error yields a 99.77% probability of passing the YFYS test over 8 years.

Source: Robeco

Robeco's Low-Carbon Climate Leaders Tilt Index, with its 50 bps ex-ante tracking error and market-like return expectations, exemplifies a viable option for superannuation funds. This index integrates both backward-looking and forward-looking climate metrics, ensuring compliance with YFYS regulations while promoting sustainability.

For funds requiring bespoke solutions, Robeco offers extensive customisation options, including the integration of the Robeco SDG framework and proven return factors.

By leveraging these strategies, superannuation funds can confidently pursue their climate objectives without compromising their regulatory compliance.

For more information, contact your local Robeco relationship manager or visit the Robeco Indices website.

Subscribe to our newsletter for investment updates and expert analysis.