Quantitative investing

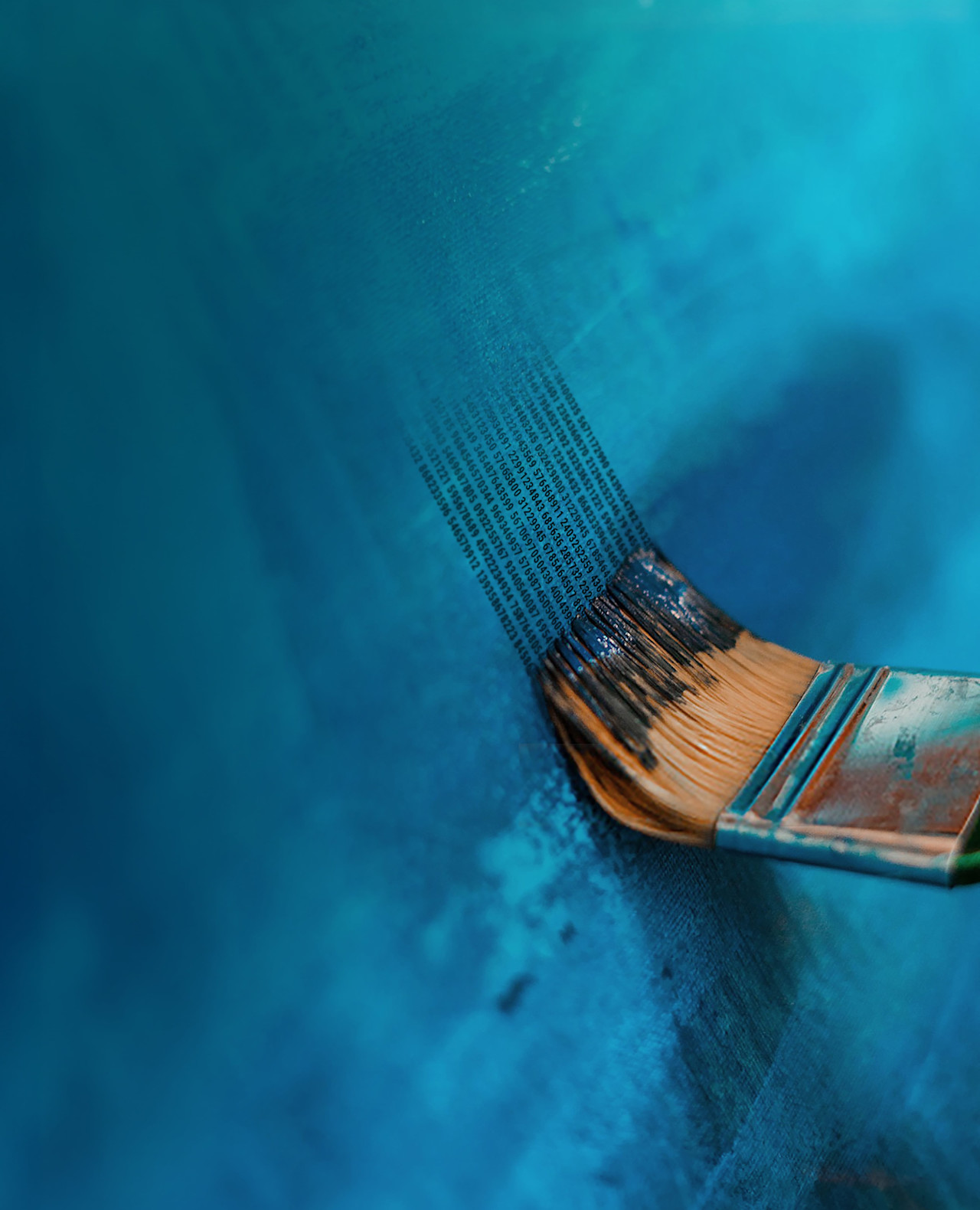

Taking emotions out of investing

At Robeco, we believe in the power of research. With our leading in-house experts, we peel back the layers and harness the driving forces that will help you build wealth sustainably.

Taking emotions out of investing

A long history of innovation

Moving beyond short-term noise

Open your portfolio to the power of themes

Creating returns that benefit the world we live in

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content: