From deterrence to dividends: Investing in Europe’s defense renaissance

The re-arming of Europe offers investment opportunities both in traditional defense industries and their related stocks, though yields may rise on government bonds, says multi-asset investor Aliki Rouffiac.

Summary

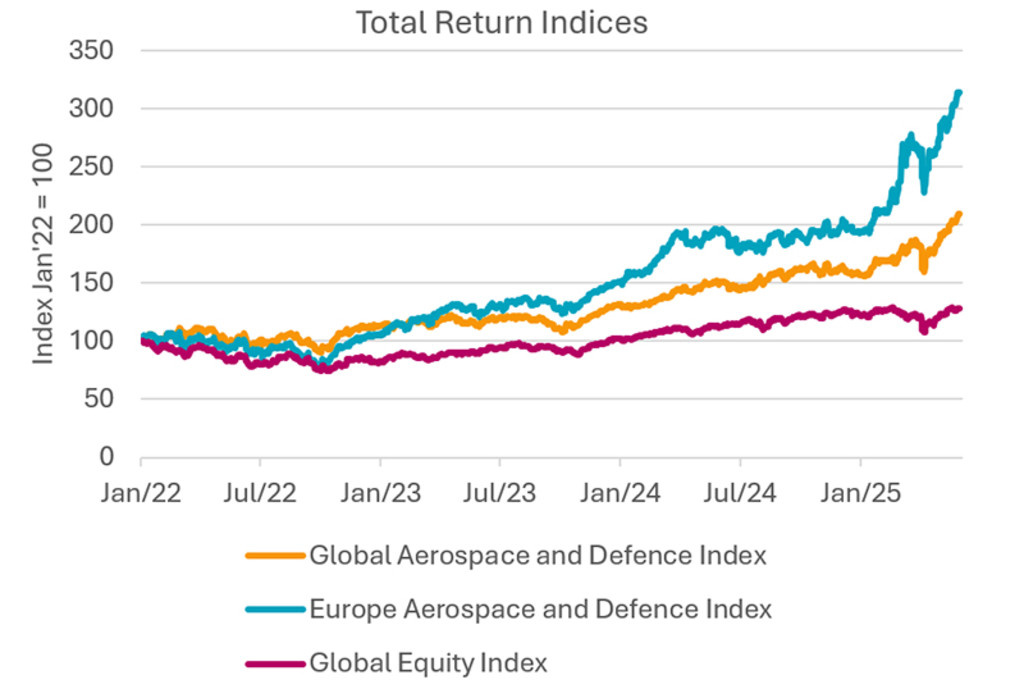

- Aerospace and defense stocks have outperformed the wider index

- Spending seen boosting defense-related sectors, rebooting growth

- Inflation risk premium may be sought on government bonds issued

European aerospace and defense stocks have outperformed the wider market this year after calls for higher national defense spending and less reliance on the historic US shield1. The ‘great rebalancing’ of military strength will be discussed at the upcoming NATO summit in The Hague later this month, where a deal agreeing to a massive rise in defense spending is expected to be endorsed.

The summit is set to trigger huge spending on defense infrastructure, from the manufacture of armored vehicles and weapons, to less obvious areas such as cybersecurity and medical technology. It could even reboot European growth, not least as infrastructure spending creates jobs, utilizes spare capacity, and adds to GDP, says Rouffiac, Portfolio Manager with Robeco Investment Solutions.

From the sustainable investing perspective, while the defense spectrum is subject to strict exclusions banning investments in controversial weapons like cluster bombs, mainstream defense investing has always been possible for the majority of Robeco’s strategies, as long as a company is not involved in severe ESG controversies.

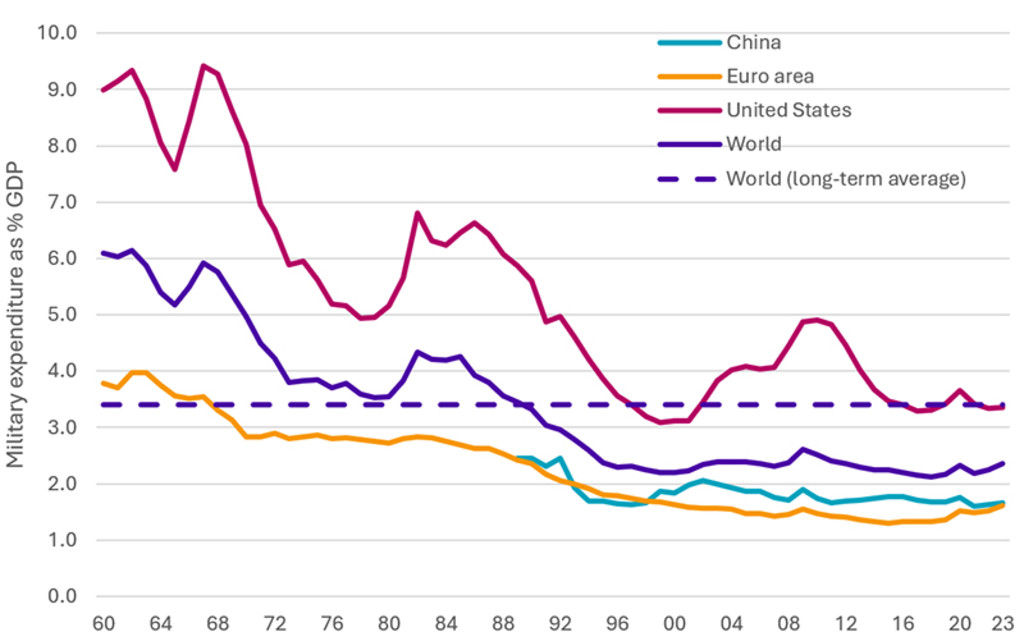

“The pace of global defense spending has picked up steam, supported by continued geopolitical tensions from the ongoing Ukraine-Russia conflict in Europe, and the shift in US policy around defense spending, which in 2024 accounted for nearly 40% of all military expenditures by countries around the world,” Rouffiac says.

“At the upcoming NATO summit, expectations are high for an agreement around defense spending commitments to reach 3.5% of each member nation’s GDP, with an additional 1.5% spending on defense-related areas like cybersecurity and infrastructure. While it remains to be seen whether these targets will be reached, it is clear that we are in the initial stages of a great rebalancing.”

“In Europe, the focus has clearly shifted to regaining military autonomy, as the US won’t be automatically doing the heavy lifting for much longer, and Europe therefore needs to achieve a certain degree of security independence in the future.”

5-year Expected Returns 2026-2030

The Stale Renaissance

Defense stocks have outperformed

Investors seeking returns from the higher expectations have not been disappointed. In equities, the global aerospace and defense sector has enjoyed a double-digit outperformance against the broader global equity market since the beginning of the year, while European stocks have outperformed their US counterparts. The MSCI European Aerospace and Defense index is though highly concentrated; the top five stocks constitute 80% of its market cap.

Source: Robeco, Bloomberg, MSCI return indices. Data as at May 2025.

“Relative forward valuations still favor European defense, which is trading at a 13% discount to the US index,” Rouffiac says. “In absolute terms, valuations of aerospace and defense companies are now at levels where earnings delivery will play a key role in future performance.”

“Conventional warfare these days covers a broad spectrum of industries such as IT, healthcare and utilities, and therefore investment opportunities outside the aerospace and defense sector can be identified in industries that are seen as supporting defense-related activities.”

“Areas such as cybersecurity and infrastructure are not only expected to benefit from higher levels of capital expenditure, but also offer better valuations relative to the more expensive aerospace and defense sector. For instance, at the end of May, the global cybersecurity index was 13% cheaper than global aerospace and defense stocks.”

The cost of security

The defense push has come since Russia’s invasion of Ukraine in 2022 and President Trump’s call for Europe to spend more on its own defense. NATO rules require spending of at least 2% of GDP, but 9 of its 32 members fall well short. An EU summit in Brussels earlier this year agreed a EUR 800 billion plan to re-arm Europe to meet threats from Russia or anywhere else.

“Fiscal constraints are traditionally a key limiting factor to rising military expenditures, with the European business cycle playing a key role on that front,” Rouffiac says. “If Europe manages to stay in overall economic expansion over the next few years, it naturally has more leeway to expand defense capabilities without threatening sovereign debt sustainability, as its debt servicing ability remains healthy.”

“Looking ahead, the ability of a monumental increase in defense spending to trigger another bout of inflation is there if it is not compensated by spending cuts or higher taxation elsewhere.”

Source: World Bank Group.

Higher risk premiums on bonds

It could though have repercussions for the government bond market, particularly if the higher spending is funded solely by issuing debt, which without a reciprocal rise in economic productivity would potentially be inflationary.

“Ultimately, higher defense spending in Europe could lead investors to demand a somewhat higher inflation risk premium when lending to governments by buying their government bonds such as German Bunds or UK Gilts,” Rouffiac says.

“Nevertheless, a rise in long-term rates wouldn’t be an unequivocally bad thing, as they capture various pricing elements, including higher nominal growth rates in the economy.”

Two mitigating factors

Rouffiac says there are two mitigating factors that could accommodate higher spending without risking an economic backlash. “First, German industry is currently facing a lot of slack, and capacity utilization that is far below trend is keeping a lid on inflation in the near term,” she says.

“Second, there are potential positive supply-side effects from innovations emerging from elevated defense spending which could act as a disinflationary force, as potential output is raised versus actual output.”

“Various professional forecaster surveys have been downgrading European growth for years, and the significant defense spending expected over the next few years might be conducive to rebooting European growth. If this is the case, a rise in long-term real interest rates reflecting a higher neutral real interest rate driven by higher productivity gains could actually be a healthy sign.”

“What is apparent is that the peace dividend is long gone, and we are reverting back to a long-run trend. If we take into account that average military expenditure has been close to the 3.5% mark for the world since 1960, we are in a sense only mean-reverting to a long-term steady-state level.”

Footnote

1 For all references to the performance of aerospace and defense stocks, past results are no guarantee of future performance. The value of your investments may fluctuate.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.