Stewardship Report 2024: Staying the course on sustainability

Sustainability has always held different meanings for different people. As a global asset manager, Robeco is increasingly seeing significant variations in regional approaches to sustainability – particularly in climate investing – reflecting the diverse markets that we serve.

Summary

- Robeco remains committed to sustainable impact and generating alpha

- Engagement and voting activities outlined in 2024 Stewardship Report

- Human rights, labor practices and biodiversity core to active ownership

In this evolving landscape, we have witnessed several large asset managers exit from the Climate Action 100+ Initiative, an exodus of North American banks and asset owners from net-zero alliances, and a potentially changing emphasis on sustainability in the new UK Stewardship Code.

However, in the interest of our clients, Robeco is staying the course when it comes to sustainability and stewardship, focusing on our key SI topics of climate change, biodiversity, social issues, corporate governance and the Sustainable Development Goals (SDGs). We strive to balance our clients’ goals of return, risk, and sustainability by attentively listening to their objectives and customizing our solutions accordingly. That is the main message of the annual Stewardship Report detailing all Active Ownership activities in 2024.

“We continue to actively engage with investee companies around key sustainability risks, impacts and opportunities, and as such we support them in building future-proof business models,” says Mark van der Kroft, Chief Investment Officer, in the introduction to the report.

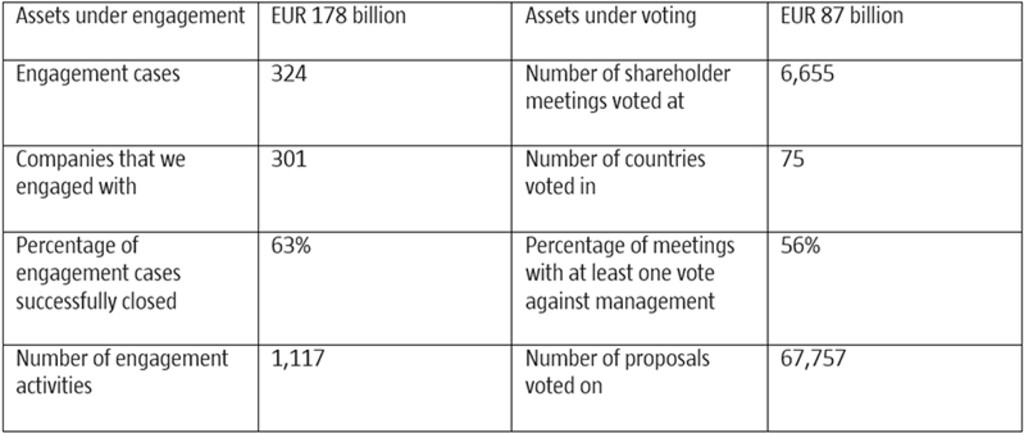

2024 key statistics

Source: Robeco, figures as at 31 December 2024

“We believe that more sustainable corporate behavior results in an improved risk-return profile of our investments. We use our engagement and voting rights to strengthen corporates’ awareness and approaches toward responsible business conduct; one constructive dialogue at a time.”

“In 2024, we further strengthened our climate engagement program and climate voting policy, managing both risks and opportunities, to the benefit of our clients and long-term value creation. During the year, we concluded several of our climate engagements successfully, with most investee companies meeting the climate expectations.”

Collaborative engagements

Robeco also took part in collaborative engagements at over 20 of the Climate Action 100+ Initiative’s focus companies, either as a lead or a contributing investor. And in line with our ‘no deforestation’ commitment, we actively engage with companies in sectors that have a considerable negative impact on biodiversity.

Biodiversity-related considerations are also included in our voting guidelines. In 2024, we engaged explicitly on the topic of biodiversity loss with more than 30 companies as part of different engagement programs, either collaboratively or directly with the investee company.

Human rights and diversity

Protecting human rights is also an important topic which is incorporated into our three-year engagements and voting activities. In 2024, we successfully closed 57% of engagement cases in the ‘Labor practices in a post Covid-19 world’, focused on improving labor standards for workers in the gig economy, hospitality, and retail sectors.

In 2025, ‘Diversity and inclusion’ will be expanded into a broader human capital management theme that addresses a wider range of workforce topics relevant to investee companies.

Driving positive change

“As we move forward, Robeco remains committed to driving positive change and fostering sustainable practices,” Van der Kroft says. “Amid growing regional differences in the adoption of sustainability, our dedication to sustainable investing, combined with our strategic engagement and voting activities, ensures that we can continue to support our clients in achieving their long-term investment goals.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.