While active credit managers typically add the most value through bottom-up security selection, we firmly believe that maintaining a top-down view is crucial for delivering sustainable outperformance in credit portfolios. Different phases of the credit cycle require varying risk stances. So, how do we adjust beta to mitigate risk and capitalize on opportunities?

As active credit managers, it is essential to steer the risk profile of the portfolio in a way that optimizes relative returns in a positive credit environment, while also mitigating negative impacts during adverse market conditions. Our top-down approach revolves around quarterly credit outlook meetings, where all members of our credit team engage in in-depth discussions, challenging and scrutinizing views on both the market and macro environment. Discussions are structured around three main factors that drive credit markets: fundamentals, valuation, and market technicals. This includes investor positioning, flows, and market liquidity.

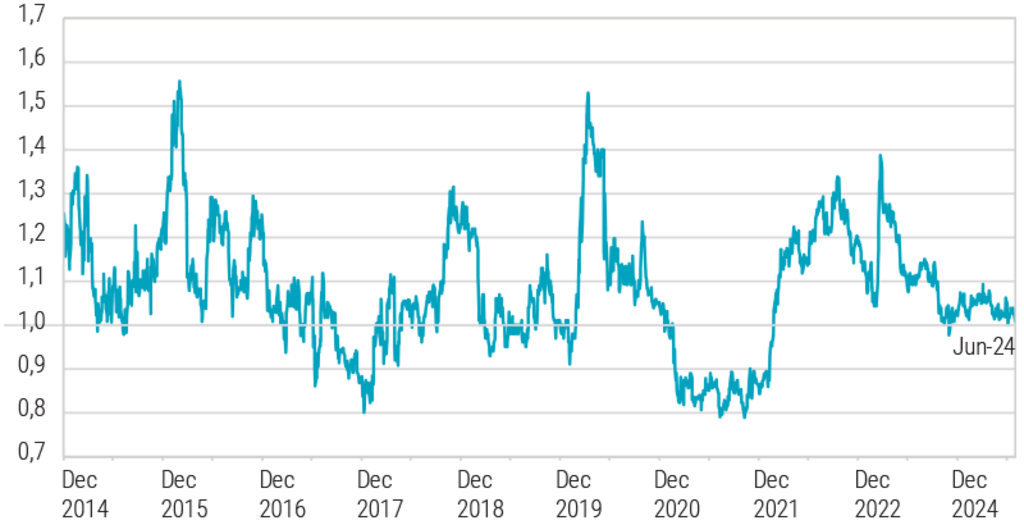

The quarterly credit outlook serves as valuable input for positioning within the market cycle. Guided by their assessment of market attractiveness, credit portfolio managers determine the overall risk positioning of portfolios, which is defined as the portfolio’s beta. Specifically, beta is calculated as the Duration Times Spread (DTS) of the portfolio divided by the DTS the relevant market index. When the top-down view suggests a preference for higher risk, portfolio managers increase the portfolio’s beta to above 1. Conversely, in a more defensive risk stance, the portfolio’s beta can be reduced to 1 or below 1.

Strategic beta positioning: Responding to credit market dynamics

The beta can be adjusted by incorporating specific strategies into credit portfolios. To increase beta, one could add to the portfolio corporate bonds with higher credit spreads, off-benchmark positions such as AT1 CoCos, or bonds with higher-spread duration than the index. Conversely, to reduce beta, outright de-risking, or adding higher-quality bonds with lower credit spreads and/or shorter-dated bonds are options. Additionally, beta can be efficiently managed by using credit index derivatives, like CDX or iTraxx. The benefit of this strategy is quick and cost-effective in comparison to using cash bonds.

The chart below illustrates the beta positioning of Robeco’s Global Credits strategy since 2014. As can be seen, a change in beta positioning occurred in Q1 2021. The portfolio managers, guided by their top-down view, opted for a more defensive risk positioning. Their assessment indicated that credit valuations were tight and no longer adequately pricing in potential risk scenarios. To lower the portfolio’s beta, high-quality and lower-spread corporate bonds were bought. Additionally, protection on the broader market was purchased using index derivatives. As a result of these actions, the portfolio’s beta was reduced to below 1.

The historical beta positioning of Robeco’s Global Credits strategy

Source: Robeco, July 2024

Additionally, a significant change in beta positioning occurred during Q1 2023. In this period, the portfolio managers adopted a defensive positioning, as evidenced by a portfolio beta close to 1. However, in March of that year we witnessed a significant widening of credit spreads, particularly in bank debt, following issues with US regional banks and Credit Suisse. The increased credit spreads created attractive value, especially in bank debt. Capitalizing on the team’s constructive view of larger systematic banks in Europe, we strategically added subordinated bank debt to the portfolio. Consequently, the inclusion of higher-spread bank debt led to an increase in the portfolio’s beta to 1.4.

To effectively manage a credit portfolio, it is crucial to maintain a top-down view. This approach ensures that the portfolio consistently delivers strong results relative to the market across different market cycles. Active beta management serves as a valuable complement to bottom-up credit selection. The use of quarterly credit outlook meetings that scrutinize fundamentals, valuations and market technicals ensures that our credit team remains agile, informed, and ready to adjust the risk profile of portfolios across different market conditions. The tactical adjustments to credit exposure and spread duration allow us to actively manage the balance between seeking outperformance in favorable conditions and mitigating risks during downturns.

Climate Global Credits DH EUR

- performance ytd (31-12)

- 4.28%

- Performance 3y (31-12)

- 3.44%

- morningstar (31-12)

- SFDR (31-12)

- Article 9

- Dividend Paying (31-12)

- No

See all articles in this series

Credit Investing opportunity

Seizing the opportunity in the credit market